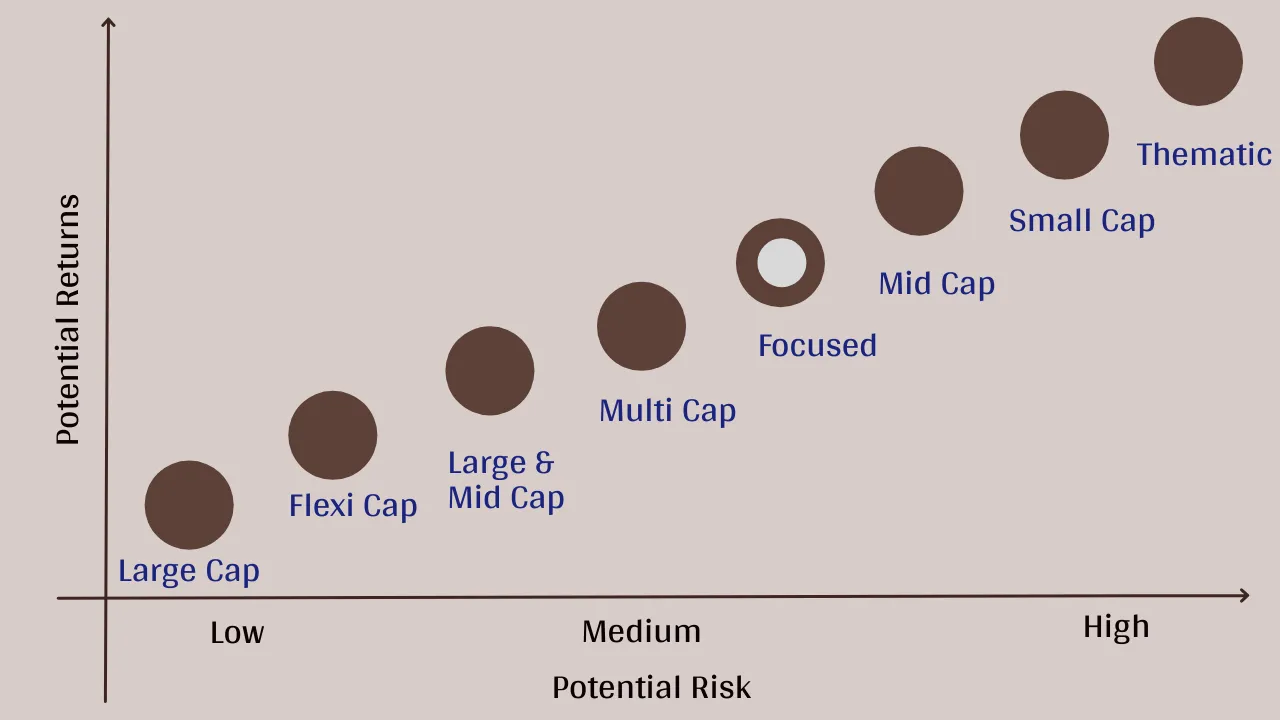

When it comes to investing in mutual funds, investors have a wide range of options to choose from. One such category is focused mutual funds, which offer a concentrated portfolio of stocks with the aim of delivering potential growth. In this article, we will explore focused mutual funds in India, understanding their key features, benefits, and considerations for investors.

Understanding Focused Mutual Funds

What are Focused Mutual Funds?

Focused mutual funds are a type of equity mutual funds that follow a concentrated investment strategy. Unlike diversified funds that hold a large number of stocks across various sectors, focused funds maintain a compact portfolio of carefully selected stocks. Typically, these funds hold around 20-30 stocks, allowing the fund manager to focus on high-conviction investments.

Key Features of Focused Mutual Funds

Concentrated Portfolio: Focused funds hold a limited number of stocks, emphasizing quality over quantity. This concentrated approach allows the fund manager to closely monitor and manage the portfolio for potential growth opportunities.

High Conviction Investing: Fund managers of focused mutual funds have strong conviction in their investment choices. They conduct thorough research and analysis to identify companies with substantial growth potential, leading to concentrated investments in those select stocks.

Flexibility: Focused funds provide flexibility to the fund manager in terms of asset allocation and sector weighting. This allows them to capitalize on emerging trends and take advantage of market opportunities.

Long-Term Orientation: Focused funds are generally suitable for investors with a long-term investment horizon. These funds aim to deliver sustainable growth over time by investing in companies with strong fundamentals and growth prospects.

Benefits of Focused Mutual Funds

Potential for Higher Returns

Focused mutual funds have the potential to generate higher returns compared to diversified funds. By investing in a concentrated portfolio of stocks, these funds aim to capitalize on the growth potential of select companies. If the chosen stocks perform well, the overall returns of the fund can be significantly higher.

Active Management and Expertise

Focused funds are actively managed by experienced fund managers who specialize in conducting in-depth research and analysis. These professionals carefully evaluate stocks and identify companies that they believe will outperform the market. Their expertise and active management can potentially result in better investment decisions.

Capitalizing on Growth Opportunities

By focusing on a limited number of stocks, focused funds allow investors to capitalize on specific growth opportunities. The concentrated approach enables the fund manager to allocate a higher proportion of the fund’s assets to companies that show strong growth potential. This targeted investment strategy can yield substantial returns if the selected stocks perform well.

Alignment with Investor Goals

Focused mutual funds are suitable for investors who have a higher risk tolerance and a long-term investment horizon. These funds are well-suited for individuals seeking potentially higher returns and are willing to accept the inherent risks associated with concentrated investing. By aligning with the investor’s risk profile and long-term goals, focused funds offer a tailored investment approach.

Considerations for Investors

While focused mutual funds have their advantages, it is essential for investors to consider a few factors before investing:

Risk and Volatility: Focused funds carry a higher degree of risk compared to diversified funds. The concentrated nature of the portfolio can lead to increased volatility in the short term. Investors should be prepared for fluctuations in the fund’s value and potential losses during market downturns.

Fund Manager Expertise: The performance of focused funds relies heavily on the expertise and track record of the fund manager. Before investing, investors should evaluate the experience, investment philosophy, and historical performance of the fund manager to ensure their investment aligns with their expectations.

Diversification: Focused funds, by nature, lack the diversification benefits that come with holding a larger number of stocks. This concentration can amplify the impact of individual stock performance on the overall portfolio. Investors should carefully assess their risk tolerance and consider diversifying their investments across different asset classes to mitigate potential risks.

Monitoring and Review: Given the concentrated nature of focused funds, investors should regularly monitor the performance and portfolio holdings. Staying informed about the fund’s investments, market trends, and any changes made by the fund manager is crucial for making informed investment decisions.

Investment Horizon: Focused funds are designed for long-term investment horizons. Investors should have a clear understanding of their financial goals, time horizon, and risk appetite before considering an investment in a focused mutual fund.

Performance of Existing Focused Mutual Funds

As of today, there are 26 Focused Mutual Funds schemes available in the market from various fund houses. The top 5 funds in this category have given returns in the range of 14.44% to 18.22% over a period of 10 years.

| Mutual Fund | AUM (Crore) | 3 Years Returns (%) | 5 Years Returns (%) | 10 Years Returns (%) |

|---|---|---|---|---|

| Nippon India Focused Equity | 6,112.01 | 31.29 | 12.27 | 18.22 |

| Franklin India Focused Equity | 8,267.99 | 30.15 | 13.57 | 17.45 |

| Quant Focused | 258.81 | 26.21 | 12.42 | 17.26 |

| SBI Focused Equity | 27,962.29 | 23.59 | 11.92 | 15.46 |

| Sundaram Focused Fund | 808.92 | 24.64 | 13.28 | 14.44 |

| NIFTY 50 TRI | - | 26.19 | 13.21 | 13.18 |

Recently Lauched and Upcoming Focused Mutual Funds

In the last 3 years period, there were 6 new Focused Mutual Fund schemes launched by fund houses. Returns delivered by these funds vary from the lower side of 4.44% to the higher side of 22.24%.

| Mutual Fund | AUM (Crore) | 1 Years Returns (%) | Since launch Returns (%) |

|---|---|---|---|

| Edelweiss Focused Equity Fund | 508.48 | - | 9.18 |

| UTI Focused Equity Fund | 508.48 | - | 4.44 |

| Canara Robeco Focused Equity Fund | 1,750.99 | 16.94 | 12.93 |

| Invesco India Focused 20 Equity | 1,639.94 | 7.81 | 16.63 |

| HSBC Focused Fund | 1,359.92 | 16.07 | 20.2 |

| Mahindra Manulife Focused Fund | 708.03 | 16.25 | 22.24 |

| NIFTY 50 TRI | - | 15.06 | 13.7 |

NFO (New Fund Offer) from ITI Mutual Fund for their “ITI Focused Equity Fund” has opened for subscription from May 29th, 2023. The fund is aiming to ride on the tailwind from the global environment in the form of expected huge FDI inflows, Digitalisation, Improved banking ROA, and Healthy trends in GST collection.

Conclusion

Focused mutual funds in India offer a concentrated approach to investing, aiming to generate potential growth for investors. With a compact portfolio of carefully selected stocks, these funds allow fund managers to focus on high-conviction investments and capitalize on growth opportunities. While focused funds have the potential for higher returns, they come with increased risks and volatility. Investors should carefully assess their risk tolerance, investment goals, and diversification needs before considering an investment in a focused mutual fund.

As with any investment, it is crucial for investors to conduct thorough research, review historical performance, and understand the expertise of the fund manager. By making informed investment decisions and aligning their investments with their long-term goals, investors can potentially benefit from the potential growth opportunities offered by focused mutual funds.