The consumer sector is a vital part of any economy, and investing in companies that cater to our everyday needs can be a strategic move. Enter Non-Cyclical Consumer Index Funds, offering a unique investment opportunity focused on businesses less susceptible to economic fluctuations.

Groww Mutual Fund has launched NFO based on Nifty Non-Cyclical Consumer Index. Lets understand more about the index first.

What are Non-Cyclical Consumer Goods?

These are products and services we consistently require, regardless of the economic climate. Think essential items like:

-

Food and Beverages: Staples like rice, milk, and cooking oil.

-

Household Products: Soaps, detergents, and personal care items.

-

Pharmaceuticals: Medicines and healthcare essentials.

-

Telecom: Mobile services and internet connectivity.

Understanding Nifty Non-Cyclical Consumer Index

The Nifty Non-Cyclical Consumer Index is a stock market index designed to track the performance of companies associated with non-cyclical consumer goods and services in India.

Composition of Index

- Comprises a maximum of 30 companies selected from the Nifty 500 universe.

- Eligibility is based on AMFI industry classification for “basic industries” and their 6-month average free-float market capitalization.

- Stock weightage is capped at 10% to ensure diversification within the index.

Sector Representation

Reconstitution of Index

- Reviewed and reconstituted semi-annually along with other Nifty Broad-based indices.

- This ensures the index remains representative of the evolving non-cyclical consumer sector.

NIFTY 50 vs NIFTY Non-Cyclical Consumer Index (NNCCI)

Returns of NIFTY 50 vs NIFTY Non-Cyclical Consumer Index

| Index | 1 Year | 3 Year | 5 Year | 10 Year | |

| NIFTY NON-CYCLICAL CONSUMER | 30.80% | 18.79% | 17.22% | 16.38% | 17.66% |

| NIFTY 50 | 20.74% | 17.12% | 16.15% | 14.57% | 15.40% |

Std. Deviation of NIFTY 50 vs NIFTY Non-Cyclical Consumer Index

| Statistics | 1 Year | 5 Year | Since Inception |

| Std. Deviation (NNCCI) | 9.96 | 16.39 | 18.92 |

| Std. Deviation (NIFTY 50) | 9.97 | 19.06 | 22.98 |

| Beta (NIFTY 50) | 0.72 | 0.72 | 0.77 |

| Correlation (NIFTY 50) | 0.72 | 0.84 | 0.87 |

As data in above 2 tables shows, Non-Cyclical Consumer Index tends has performed better compared to NIFTY 50 over various time periods with lesser volatility.

About Groww Mutual Fund

Nextbillion Technology, the company behind the popular investment platform Groww, acquired the mutual fund business of Indiabulls Housing Finance (IBHFL) in 2023. This acquisition was then relaunched as Groww Mutual Fund.

As of today, Groww Mutual Fund manages a total Asset Under Management (AUM) of approximately Rs. 708 crores across 10 different mutuchal fund schemes.

Groww NIFTY Non-Cyclical Consumer Index Fund

This index fund tracks the Nifty Non-Cyclical Consumer Index-TRI, focusing on companies that provide essential goods and services often referred to as “Roti-Kapda-Makaan” (food, clothing, and shelter) in India. Leading the team is Mr. Abhishek Jain, a Chartered Accountant with 12 years of experience in the Equity Market.

Prior to joining Groww Mutual Fund (GMF), Mr. Jain honed his expertise in financial services through roles at:

- Edelweiss Tokio Life Insurance (Senior Dealer)

- Acko General Insurance

- Shriram Asset Management Co. Ltd.

Mr. Jain’s extensive experience in the equities market positions him well to manage this index fund.

NFO period

This exciting new fund is open for subscription from May 2nd, 2024 to May 16th, 2024. After the NFO (New Fund Offer) period closes, the fund will reopen for further investment at a later date.

Minimum Investment:

-

One-time Investment: A minimum of Rs. 500 is required during the NFO period.

-

SIP (Systematic Investment Plan): You can also set up a monthly SIP (Systematic Investment Plan) during the NFO with a minimum investment of Rs. 100 per month for a period of 12 months.

-

Quarterly SIP: If you prefer a quarterly SIP, the minimum investment amount is Rs. 300 per installment.

Why Invest in a Groww Non-Cyclical Consumer Index Fund?

-

Stability: Demand for Non-Cyclical products remains relatively stable even during economic downturns, offering a degree of protection from market volatility.

-

Growth Potential: As the population grows and disposable incomes rise, the demand for these goods and services is likely to increase, leading to potential long-term growth.

-

Diversification: Adding a Non-Cyclical Consumer Index Fund to your portfolio can provide diversification benefits, mitigating overall risk.

-

Professional Management: This fund is managed by experts who track the performance of a specific index, the Nifty Non-Cyclical Consumer Index, ensuring a diversified basket of stocks.

-

Low expense: Being Index fund, expense ratio of this fund is expected to be less, resulting in better returns for investor.

Things to Consider

-

Investment Horizon: Index funds are suitable for long-term investment goals due to the inherent nature of the underlying companies.

-

Expense Ratio: Being Index fund results in lower expense ratios which translate to higher returns for you.

Conclusion

Groww Non-Cyclical Consumer Index Fund offer a compelling way to tap into the stability and potential growth of the consumer sector. By understanding the underlying assets and aligning it with your investment goals, you can potentially benefit from this unique investment avenue.

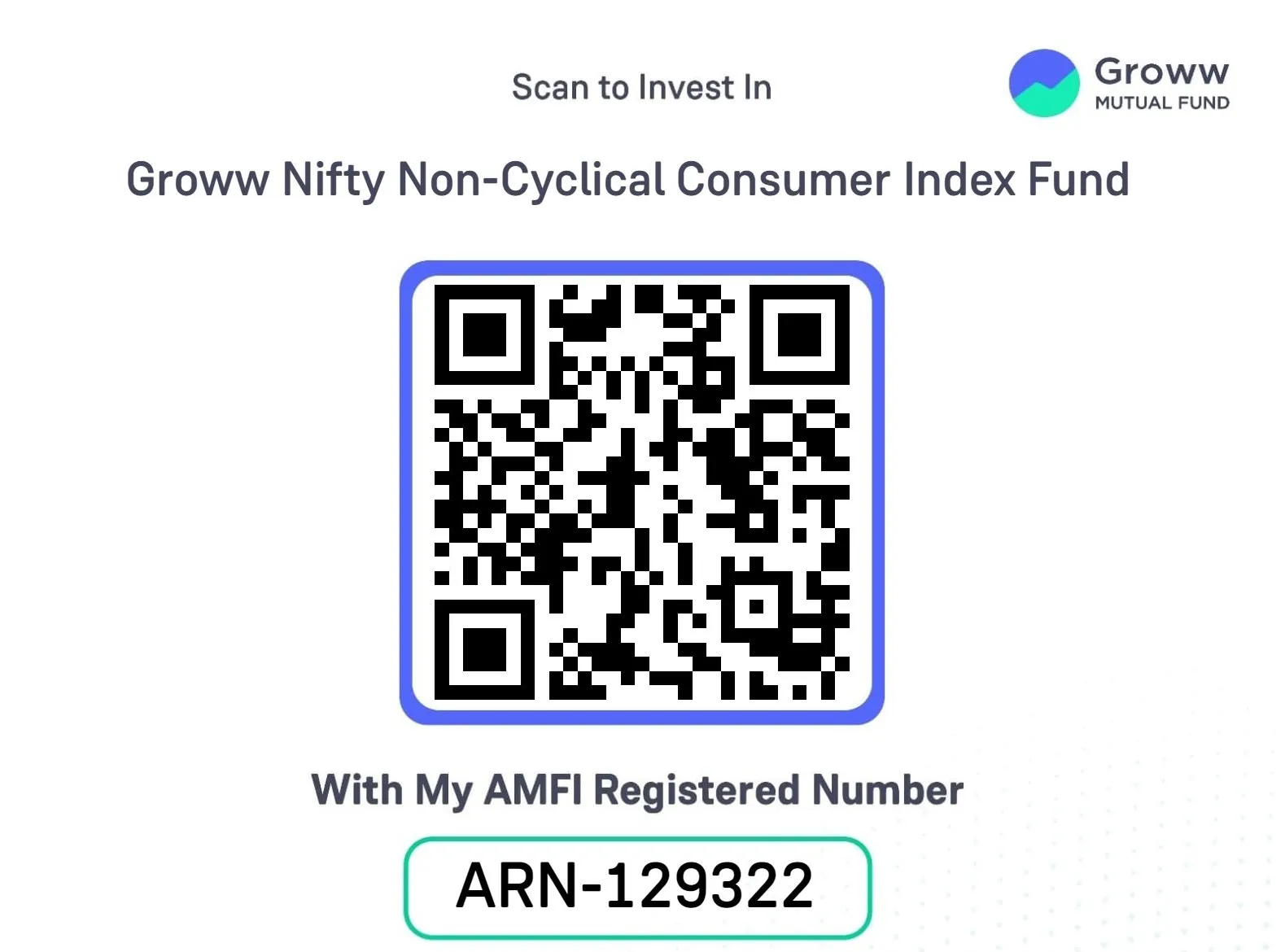

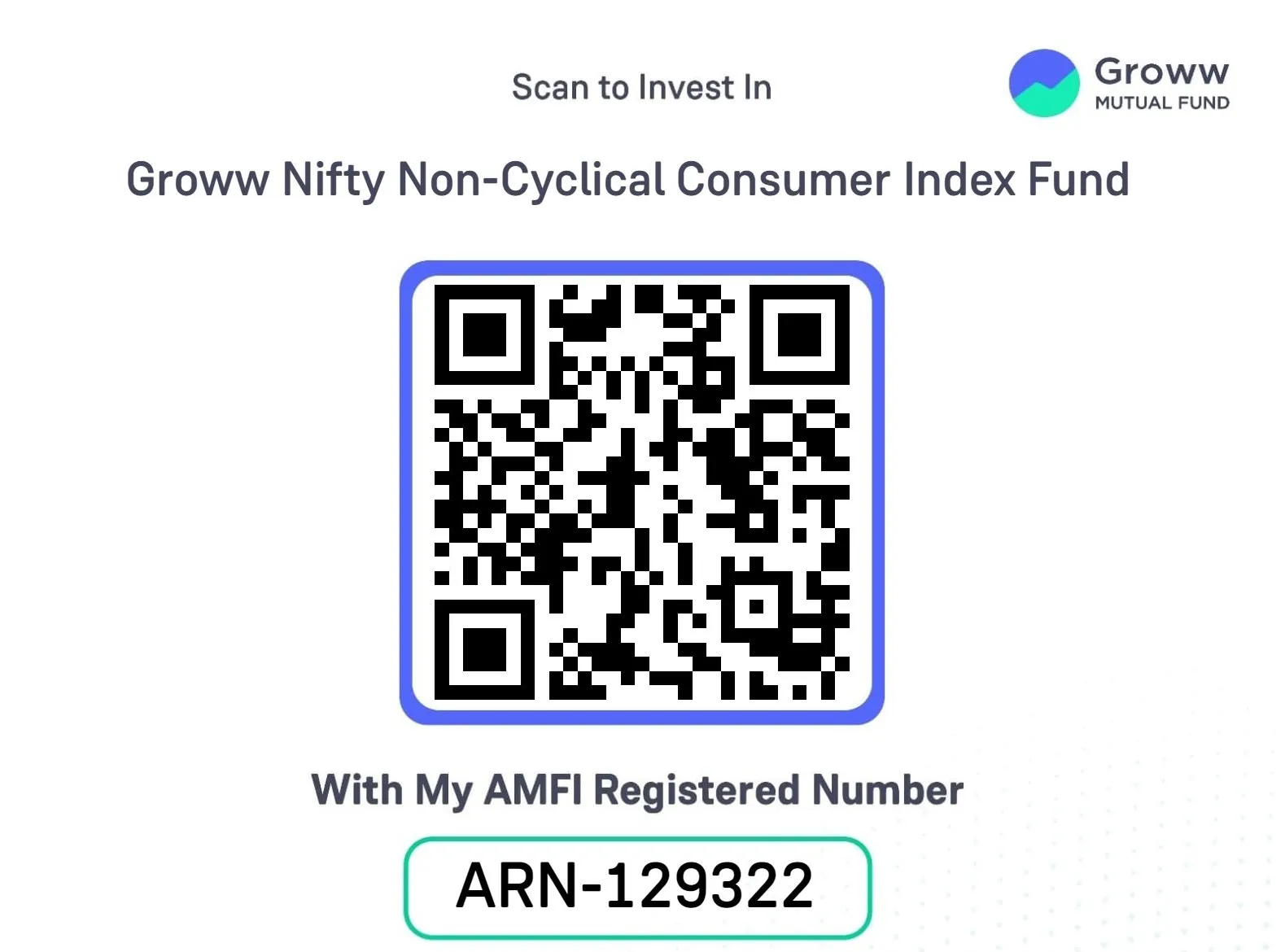

Ready To Invest?

Scan the QR code to subscribe for the NFO of Groww Non-Cyclical Consumer Index Fund via us.

3 Easy steps to follow for investing.

- Scan the QR code

- Review and Validate Details

- Complete Payment

For any clarification connect with us.