Nido Home Finance Limited (formerly known as Edelweiss Housing Finance Limited), a part of the Edelweiss Group, is a Housing Finance Company that has been providing access to credit to customers for various kinds of loans since 2010. Nido Home Finance (NHFL) is 100% subsidiary of EFSL.

Edelweiss Group at a glance

- Net worth : ~INR 6,046 cr

- liquidity : ~ INR 3,300 cr

- Q3FY24 PAT(Ex-Insurance): INR 183 cr

Business model – focused on affordable housing:

- What: Small ticket home loans with an avg. loan size of ~25 lacs

- Where: In BHARAT - tier 2 & 3 towns with high margins

- How: Co lending with SBI and SCB. Asset light model

Growth in co-lending - 80% book is under co lending model with Banks like SBI, BOB and SCB etc. Strong backing and credit lines at subsidized rates from marquee PSU banks and financial institutions like

- SBI – 250 cr

- IOB – 75 cr

- National housing board (NHB) – 25 cr

External validation of loan quality via securitization and co-lending. Strong collateral (house property assets) and high recovery visibility due to SARFAESI act.

Key Financials:

- Collection efficiency for the quarter at 98.7%

- GNPA at 2.24%

- Net NPA is 1.61%

- The NIM is in the range of 4%

| Title | Details |

| Issue opens | Tuesday, February 13, 2024 |

| Issue closes | Monday, February 26, 2024 |

| Allotment | First Come First Serve Basis |

| Face Value | Rs.1,000 per NCD |

| Issue Price | Rs.1,000 per NCD |

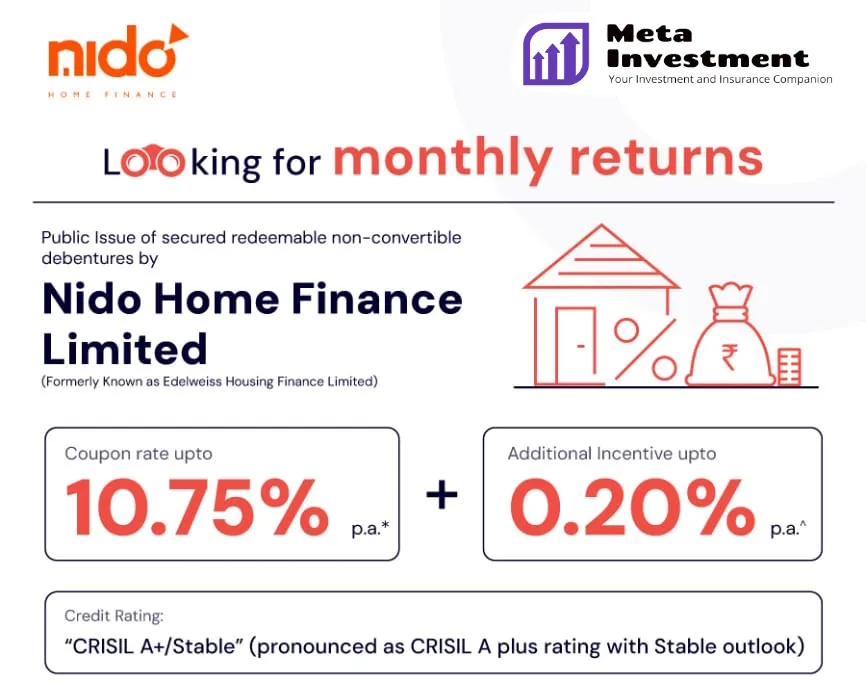

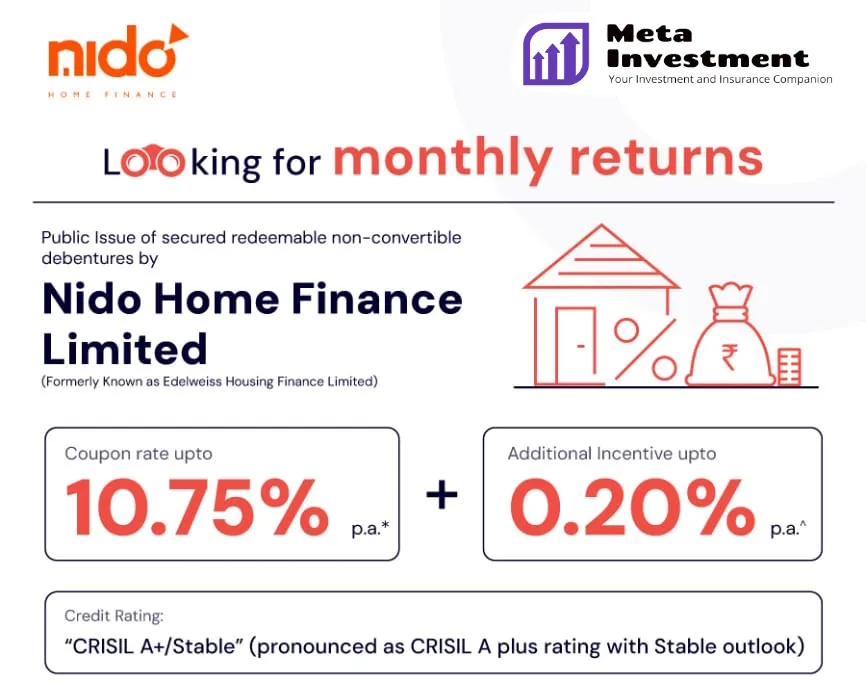

| Nature of Instrument | Secured Redeemable Non-Convertible Debentures |

| Minimum Application | 10 NCDs (Rs.10, 000) & in multiple of 1 NCD thereafter |

| Tenure | 24, 36, 60, and 120 Months |

| Interest Payment frequency | Monthly, Annually, and Cummulative |

| Listing | BSE |

| Rating | ICRA A+, CRISIL A+/Stable |

Capital amortization options in Current NCD issue

- 5-year NCD – 50% in Year 4 and 50% in year 5

- 10 Year NCD – 20% from Year 6 to 10

Get 0.20% extra across all tenures if Edelweiss shares are bought on or before – 23rd Feb, 2024

Attractive Interest Rates

2Y: 9.50%, 3Y : 10%, 5Y: 10.50% and 10Y : 10.75%

NCD closes on 26th Feb, 2024. Out of INR 100cr Issue size, INR 71Cr already subscribed with healthy subscription from QIB, Corporate, HNI and Retail investors.