Edelweiss is one of India’s leading financial services conglomerates having presense in multiple lines of businesses.

Edelweiss Financial Services Limited (“EFSL”), was incorporated on November 21, 1995 under the name Edelweiss Capital Limited and started operations as an investment banking firm after receipt of a Category II license from SEBI. Edelweiss Capital Limited subsequently received a Category I Merchant Banker license from SEBI with effect from October 16, 2000. The name of Edelweiss Capital Limited was changed to ‘Edelweiss Financial Services Limited’ with effect from August 1, 2011.

Edelweiss Financial Services Limited (“EFSL”), was incorporated on November 21, 1995 under the name Edelweiss Capital Limited and started operations as an investment banking firm after receipt of a Category II license from SEBI. Edelweiss Capital Limited subsequently received a Category I Merchant Banker license from SEBI with effect from October 16, 2000. The name of Edelweiss Capital Limited was changed to ‘Edelweiss Financial Services Limited’ with effect from August 1, 2011.

Key lines of business of Edelweiss are

- Retail Credit (Home Loans, SME and Business Loans)

- Asset Management (Mutual Funds and Alternative Assets)

- Asset Reconstruction

- Insurance (Life, General)

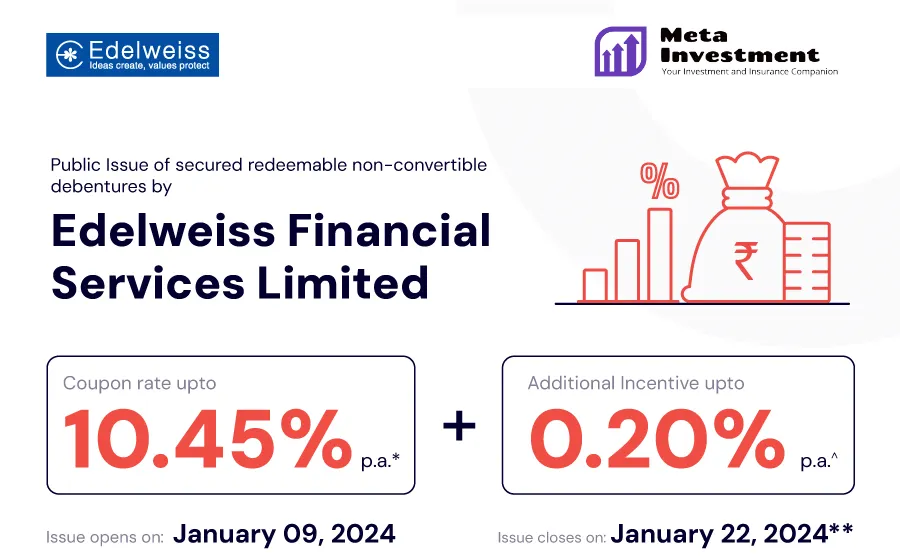

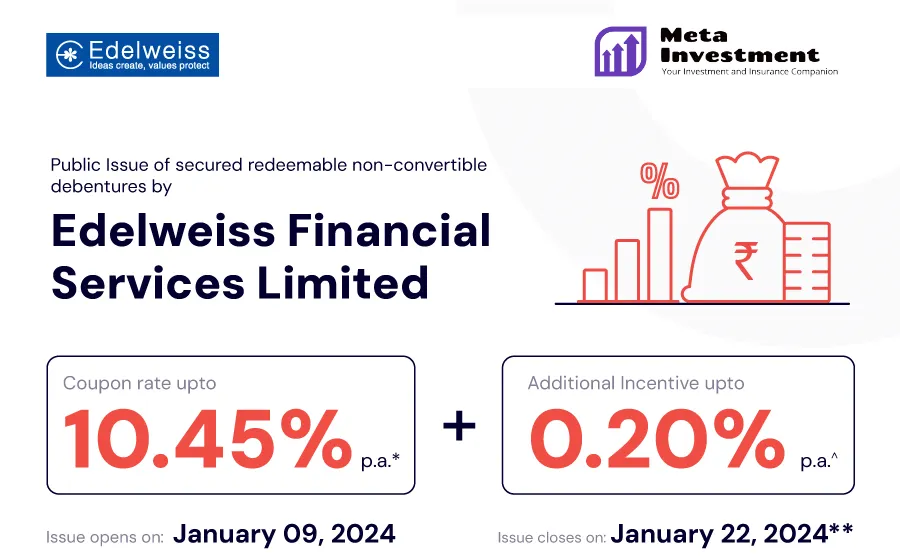

About NCD issue

This Public NCD issue has base issue size of ₹ 1,250 million with an option to retain over- subscription up to ₹ 1,250 million aggregating up to ₹ 2,500 million.

| Title | Details |

| Issue opens | Tuesday, January 09, 2024 |

| Issue closes | Monday, January 22, 2024 |

| Allotment | First Come First Serve Basis |

| Face Value | Rs.1,000 per NCD |

| Issue Price | Rs.1,000 per NCD |

| Nature of Instrument | Secured Redeemable Non-Convertible Debentures |

| Minimum Application | 10 NCDs (Rs.10, 000) & in multiple of 1 NCD thereafter |

| Tenure | 24, 36, 60, and 120 Months |

| Interest Payment frequency | Monthly, Annually, and Cummulative |

| Listing | BSE |

| Rating | ICRA A+, CRISIL A+/Stable |

EDELWEISS FINANCIAL SERVICES NCD Jan-2024 – Interest Rates

| Series | I | II | III | IV | V | VI | VII | VIII | IX | X |

|

|

| Frequency of Interest Payment | Annual | NA | Monthly | Annual | NA | Monthly | Annual | NA | Monthly | Annual |

| Tenor | 24 months | 24 months | 36 months | 36 months | 36 months | 60 months | 60 months | 60 months | 120 months | 120 months |

| Frequency of Interest Payment | Annual | | Monthly | Annual | | Monthly | Annual | | Monthly | Annual |

| Amount (₹ / NCD) on Maturity for NCD Holders in Category I, II, III & IV | ₹1,000 | ₹1,187.30 | ₹1,000 | ₹1,000 | ₹1,317.00 | ₹1,000 | ₹1,000 | ₹1,618.70 | ₹1,000 | ₹1,000 |

| Coupon (% per annum) for Category I, II, III & Iv | 8.95% | | 9.20% | 9.60% | | 9.67% | 10.10% | | 10.00% | 10.45% |

| Effective Yield (per annum) for in Category I, II, III & IV | 8.94% | 8.95% | 9.59% | 9.59% | 9.60% | 10.10% | 10.09% | 10.10% | 10.46% | 10.44% |

Detailed product note can be downloaded from our download section as well.

How to invest in Edelweiss financial services Jan-2024 NCD Online?

Meta Investment works with Lead Manager of issue Nuvama Wealth Management Limited to offer complete online and seamless investing in this NCD. Connect with us today to subscribe to this NCD.

Edelweiss Financial Services Limited (“EFSL”), was incorporated on November 21, 1995 under the name Edelweiss Capital Limited and started operations as an investment banking firm after receipt of a Category II license from SEBI. Edelweiss Capital Limited subsequently received a Category I Merchant Banker license from SEBI with effect from October 16, 2000. The name of Edelweiss Capital Limited was changed to ‘Edelweiss Financial Services Limited’ with effect from August 1, 2011.

Edelweiss Financial Services Limited (“EFSL”), was incorporated on November 21, 1995 under the name Edelweiss Capital Limited and started operations as an investment banking firm after receipt of a Category II license from SEBI. Edelweiss Capital Limited subsequently received a Category I Merchant Banker license from SEBI with effect from October 16, 2000. The name of Edelweiss Capital Limited was changed to ‘Edelweiss Financial Services Limited’ with effect from August 1, 2011.