In the world of investing, understanding macroeconomic indicators is crucial for making informed decisions. One such critical metric is the Global Economic Policy Uncertainty (GEPU) Index.

For Indian investors, this index is not just a theoretical concept but a practical tool to gauge risks and opportunities in the market. Let’s break down what GEPU is, why it matters, and how it impacts investments in India.

What is the GEPU Index?

The GEPU Index is a globally recognized measure that quantifies uncertainty in economic policies across major economies. It tracks factors like:

- Changes in tax policies

- Regulatory shifts

- Trade tensions (e.g., US-China trade wars)

- Geopolitical risks (e.g., conflicts, sanctions)

- Central bank actions (e.g., interest rate changes)

The index is constructed using data from news articles, government reports, and economic forecasts. A higher GEPU score indicates greater uncertainty, while a lower score suggests stability.

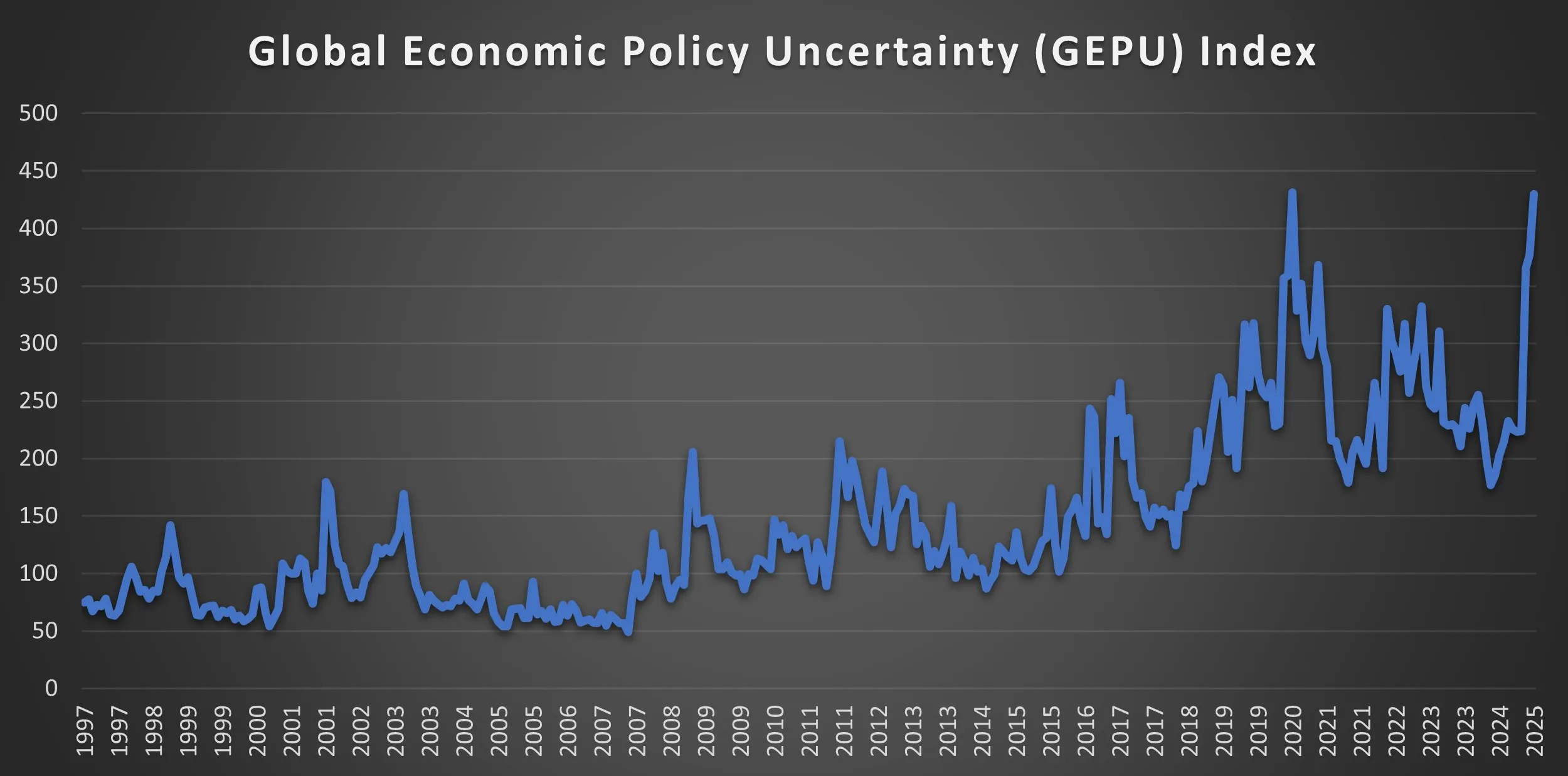

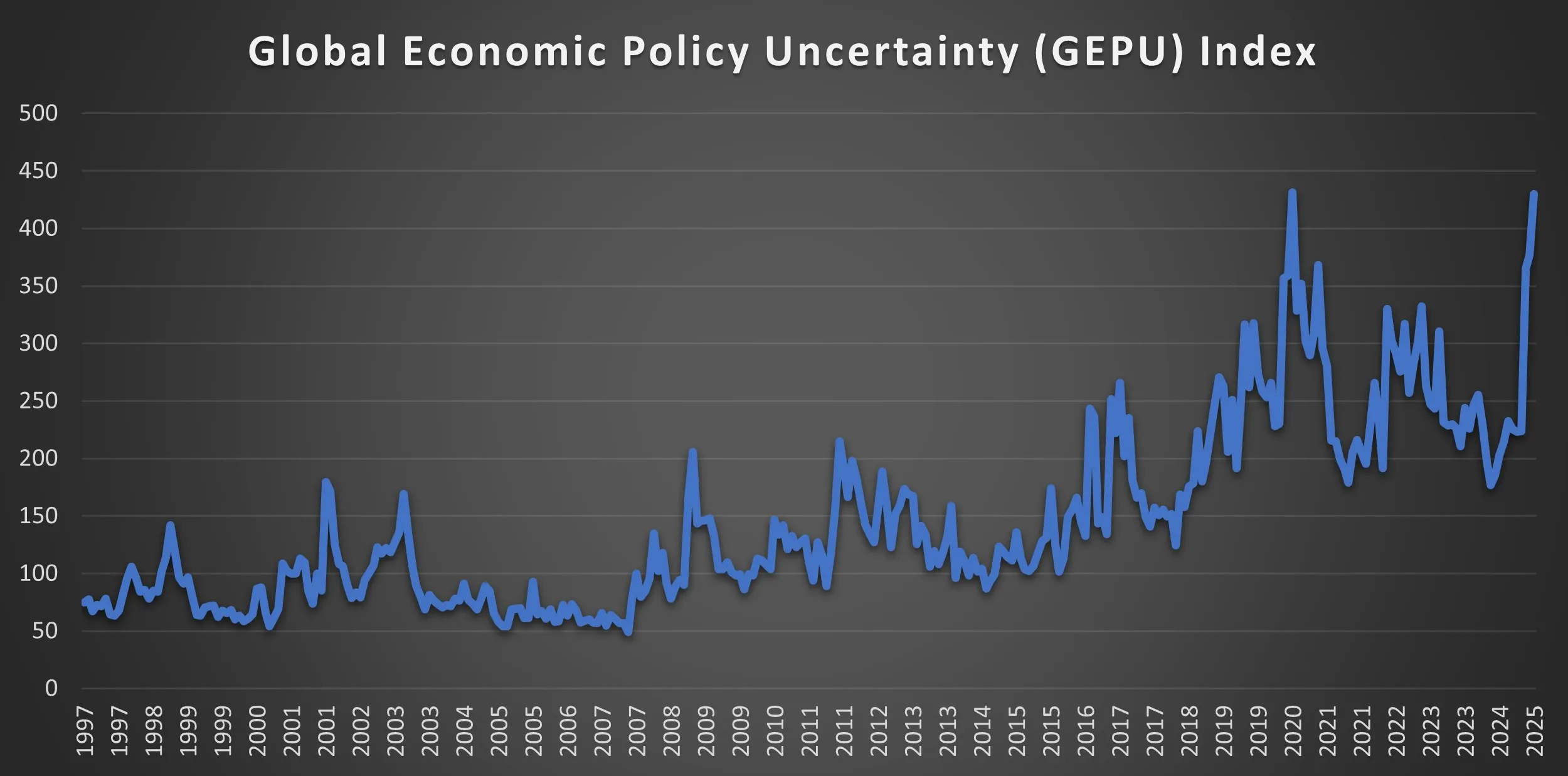

Historical Trends:

-

1997-2000: The GEPU index remained relatively stable, with occasional spikes. For example, in December 1997, the index peaked at 105.96 (GEPU_current) due to the Asian Financial Crisis.

-

2001-2003: The index saw significant spikes, particularly in September 2001 (179.70) and March 2003 (169.19), coinciding with the 9/11 attacks and the Iraq War, respectively.

-

2008-2009: The Global Financial Crisis caused a massive surge in uncertainty, with the index reaching 205.90 in October 2008 and remaining elevated throughout 2009.

-

2011-2012: The Eurozone debt crisis and US debt ceiling debates led to another spike, peaking at 214.76 in August 2011.

-

2016: The Brexit referendum and US presidential election caused a sharp rise, with the index hitting 243.33 in June 2016.

-

2020: The COVID-19 pandemic caused the highest spike in the index’s history, reaching 431.57 in May 2020, reflecting unprecedented global uncertainty.

-

2022-2023: The Russia-Ukraine war, inflation concerns, and central bank tightening policies kept the index elevated, with peaks in March 2022 (329.92) and March 2023 (310.58).

-

2024-2025: The tariff war initiated by the newly elected US President, Donald Trump, led to a significant spike in the GEPU Index.

Why Should Indian Investors Care About GEPU?

India is deeply integrated into the global economy. Whether it’s foreign institutional investments (FIIs), export-import dynamics, or corporate earnings, global economic policy uncertainty has a ripple effect on Indian markets. Here’s how GEPU impacts investments:

1. Foreign Institutional Investments (FIIs):

- FIIs are a major driver of Indian equity markets. When global uncertainty rises (high GEPU), foreign investors often adopt a “risk-off” approach, pulling money out of emerging markets like India and moving to safer assets like US Treasuries or gold.

- This can lead to volatility in Indian stock markets, affecting equity mutual funds and direct stock investments.

2. Currency Fluctuations:

- A high GEPU often weakens emerging market currencies, including the Indian rupee. A weaker rupee can increase the cost of imports (e.g., crude oil, electronics), leading to higher inflation and impacting sectors like automobiles, FMCG, and pharmaceuticals.

- For debt investors, currency volatility can affect the returns of international bond funds or funds with foreign exposure.

3. Corporate Earnings:

- Global uncertainty can disrupt supply chains, increase input costs, and reduce demand for Indian exports. Companies in sectors like IT, pharmaceuticals, and metals are particularly vulnerable.

- This can lead to lower corporate earnings, impacting stock prices and equity mutual fund NAVs.

4. Commodity Prices:

- India is a major importer of crude oil and gold. High GEPU often leads to fluctuations in commodity prices, which can impact inflation and interest rates in India.

- Rising oil prices, for instance, can hurt sectors like aviation, logistics, and paints, while benefiting oil marketing companies.

5. Domestic Policy Responses:

- In times of high global uncertainty, the Indian government and the Reserve Bank of India (RBI) may adjust fiscal and monetary policies. For example, the RBI might cut interest rates to stimulate growth or increase liquidity in the system.

- Such measures can influence bond yields, fixed deposit rates, and the performance of debt mutual funds.

How to Use GEPU in Investment Strategy

The GEPU Index can serve as a risk management tool rather than a timing indicator. Here’s how it can be incorporated into an investment approach:

1. Diversify Your Portfolio:

- During periods of high GEPU, diversifying across asset classes (equity, debt, gold, and real estate) can help reduce risk.

- Allocating more to defensive sectors like FMCG, healthcare, and utilities, which tend to perform better in uncertain times, may also be beneficial.

2. Focus on Quality:

- Investing in high-quality stocks and mutual funds with strong fundamentals, low debt, and consistent earnings can provide resilience during global uncertainty.

3. Increase Exposure to Domestic-Focused Sectors:

- Sectors like banking, infrastructure, and consumer goods, which rely more on domestic demand, are less affected by global uncertainty compared to export-oriented sectors.

4. Use Systematic Investment Plans (SIPs):

- Volatility caused by high GEPU can create buying opportunities. SIPs allow for regular investments, averaging out market fluctuations and benefiting from lower valuations.

5. Monitor Debt Investments:

- In uncertain times, interest rates may fluctuate. Short-duration debt funds or dynamic bond funds that can adapt to changing rate scenarios may be worth considering.

- While GEPU is a useful indicator, avoiding impulsive decisions based on short-term spikes in uncertainty is key. Focusing on long-term financial goals and sticking to a well-defined asset allocation plan is essential.

Current Scenario: GEPU and India

As of 2025, global economic policy uncertainty remains elevated due to factors like:

- Ongoing geopolitical tensions (e.g., Russia-Ukraine conflict)

- Central banks tightening monetary policies to combat inflation

- Slowing global growth and recession fears

For Indian investors, this means staying cautious but not overly defensive. India’s relatively strong domestic economy, robust forex reserves, and proactive policy measures provide a cushion against global headwinds.

Conclusion: GEPU as a Compass, Not a Crystal Ball

The GEPU Index is a valuable tool for understanding the global economic landscape and its impact on Indian markets. However, it’s not a standalone indicator. Combining it with other metrics like GDP growth, inflation, and corporate earnings can help make informed investment decisions.

The key takeaway is to stay disciplined, focus on financial goals, and use tools like GEPU to navigate uncertainty rather than fear it. Volatility is not a risk but an opportunity for those who are prepared.

Disclaimer: This article is for informational purposes only and should not be construed as investment advice. Please consult a financial advisor before making any investment decisions.