Read more about

- Meta Investment | AMFI-Registered Mutual Fund Distributor | SIP & Financial Planning India

- Corporate NPS – Tax Benefits & How It Works for Employers

- NPS FAQ's

- NRI Investments in GIFT City | Tax-Efficient IFSC Investment Services

- Understanding Gold ETFs - A Wise Investment Choice

- Diwali 2025 Gold MLD Investment | Principal Protection & Growth for Pune Investors

- Gold Investment – Best Ways to Invest in Gold (ETF, SGB, Physical)

- How Much Money Do You Need to Retire Comfortably in India? (2025 Guide)

- Retirement Planning for Different Life Stages: A Step-by-Step Guide

- NPS Vatsalya

- NPS Scheme - National Pension System Benefits, Tax Savings & How to Invest

- NRI Investment Options in India | Expert Financial Solutions

- Public Provident Fund (PPF) - The Ultimate Tax-Saving Investment for Long-Term Growth

- Retirement Planning: A Comprehensive Guide to Secure Your Future

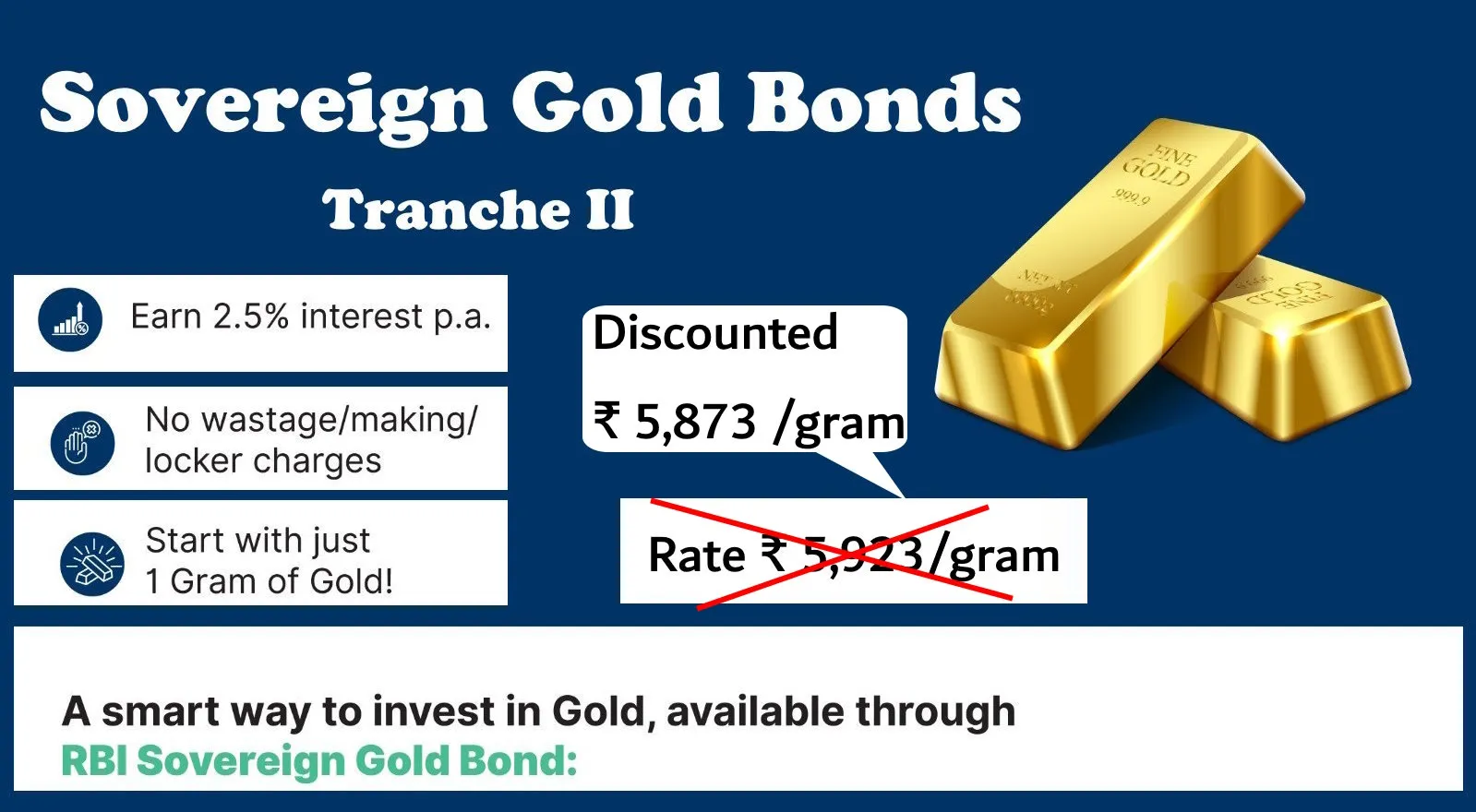

- Understanding Sovereign Gold Bonds (SGB) in India

- SIP in Digital Gold and Silver: Celebrate Diwali Dhanteras with Smart Investing in 2025

- Will and Estate Planning: Securing Your Legacy and Protecting Your Loved Ones

Related posts

- Mutual Fund Scheme Name Changes in India (2025) – Complete List & Reasons

- Mutual Funds Are the New Status Symbol (Not Your Bank Balance)

- Adani Enterprises NCDs 2025 – Safe Investment with 9.3% Returns?

- New SEBI-Validated UPI IDs: Secure Payments for Investors Explained

- HDFC Life Click 2 Achieve – Guaranteed Savings Plan with Life Cover

- Union Budget 2025: TDS/TCS Changes & Personal Income Tax Slab Changes

- Key Union Budget Announcements - 2025

- Pre-Budget Portfolio Tune-Up: 3 Things to Consider Now

- Navigating The Current Equity Market Correction

- A New Way to Play India's Large-Cap Growth Story

- Equity Linked Savings Schemes

- Myths of Index Investing in India

- Financial Independence for Our Heroes: Investment Strategies for Indian Army Personnel

- Meta Investment App Now Available in Google Play Store

- 11% EDELWEISS FINANCIAL SERVICES Secured NCD Open for subscription

- Mutual Fund Mystery: Online Platform, Missing Money?

- Demystifying Annuities: Your Retirement Income Lifeline?

- Brewing a Better Future: How Chai Can Teach You About Smart Investments

- Jain Principles for a Prosperous and Ethical Investment Journey

- Ram Navami: A Time for Reflection, Financial Planning, and New Beginnings

- NFO Alert : Bandhan Mutual Fund Launches Innovation Fund

- जुनं फर्निचर Juna Furniture (Old Furniture): A Stark Reminder of the Importance of Retirement Planning

- A Look Back at 10 Years of Performance of Equity schemes of NPS

- Kaun thi woh AUNTY?

- P2P Association Pauses Liquid Funds in India: What You Need to Know

- Ensuring Retirement Bliss: Key Factors to Assess Retirement Income Sufficiency

- Motilal Oswal Nifty Microcap 250 Index Fund - High Risk, High Reward Potential?

- "10 Reasons to invest in Arbitrage Funds"

- No Smoking Day - Invest in Your Health and Wealth

- Unlocking Your Life Goals - Overcoming Financial Barriers with Smart Investments

- All about HDFC Reality Index Fund NFO

- Edelweiss Mutual Fund launched new NFO with Technology theme

- HDFC Mutual Funds Year Book 2024

- 10.4% EDELWEISS FINANCIAL SERVICES Secured NCD Open for subscription

- quant Mutual Fund launched new NFO with consumption theme

- Unlocking Opportunities: Investing in US Stocks for Indians

- ULIP vs Mutual Funds in India

- 🌟 Exclusive Ganesh Chaturthi Offer 🌟

- Barni's Magic: Rani's Financial Adventure

- Balancing Financial Independence - Drawing Lessons from Shivaji Maharaj

- Impact Investing with P2P Lending

- Happy Akshaya Trithiya

- 5 Steps to Getting Started in Investing for Young Indians

- Investing for Building Wealth: What Cricket Can Teach Us

- Rupeek Bonds

- Berar Aug'22 Bond's

- From Millennials To Millionaires

- EMI vs SIP

- All Weather Gold: A Principal-Protected Way to Bet on Gold (Until Aug 31)

- The Ultimate Guide to Investing in Silver: Digital, ETFs, and Physical Options

- Gold vs. Mutual Funds vs. Multi-Asset Funds: Best Investment for Akshaya Tritiya 2025

- Edelweiss Gold Structured Products: A Smart Way to Invest in Gold with Principal Protection

- From Cricket to Code to Fitness: Investment Lessons from India’s ICC Champions Trophy 2025 Win

- Gold Investments: A Casual WhatsApp Group Discussion of Friends (Ft. Bachat Babu’s Wisdom)

- The Ever-Shifting Sands: Why Asset Allocation is Key to Investment Success

- 📢📢 Buy gold in a new avatar, this Dhanteras!

- Don't invest this Diwali

- Gold: A Timeless Investment - How Mutual Funds Make It Easier

- Gold vs FD: Exploring the Pros and Cons