What is a Specialized Investment Fund (SIF)?

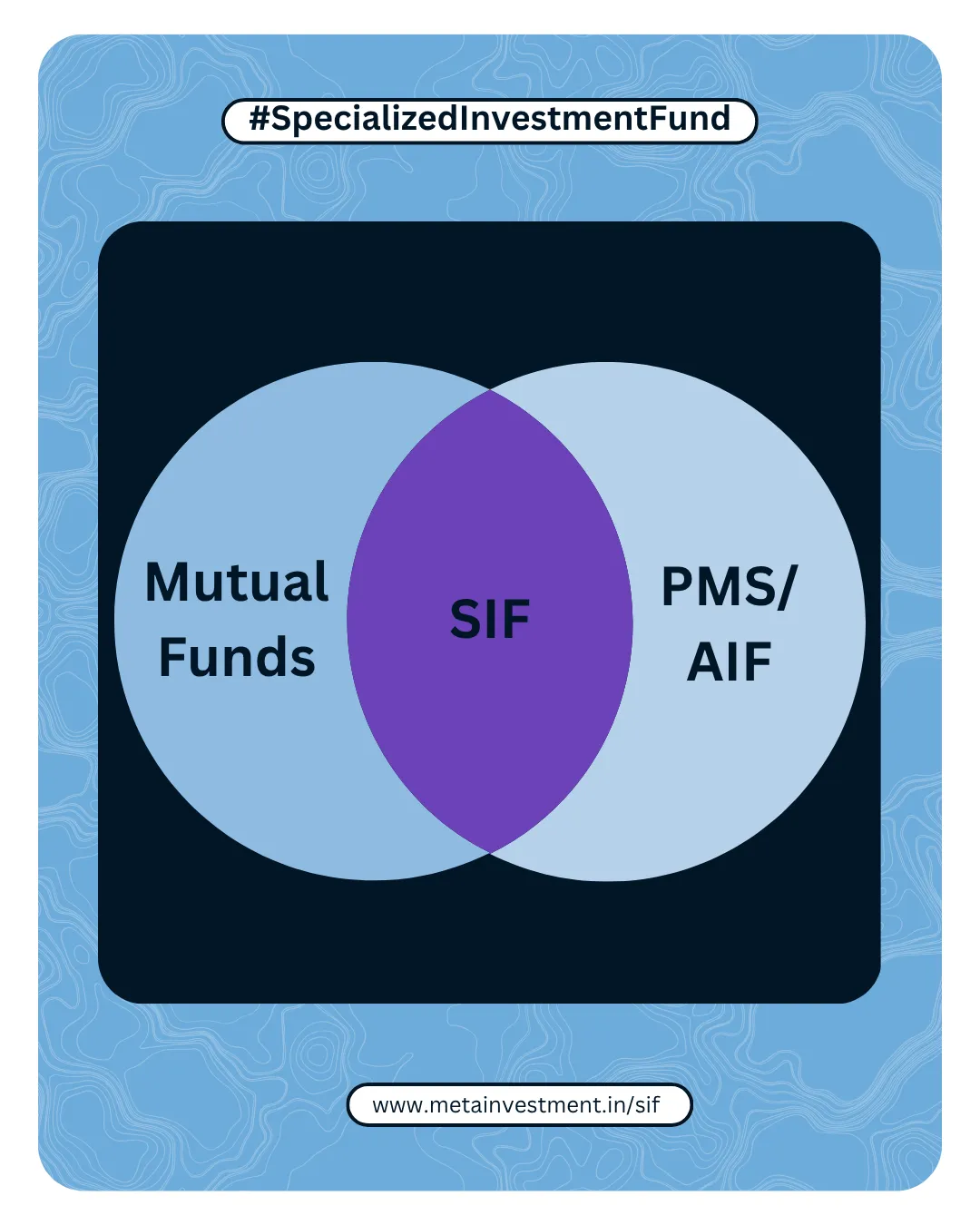

A Specialized Investment Fund (SIF) is a new investment product introduced by SEBI to bridge the gap between Mutual Funds and Portfolio Management Services (PMS) and Alternative Investment Funds (AIFs). SIFs are designed to offer greater portfolio flexibility and cater to sophisticated investors who seek more tailored investment strategies. SIFs are regulated under the SEBI (Mutual Funds) Regulations, 1996, and come with a set of eligibility criteria, branding requirements, and investment guidelines.

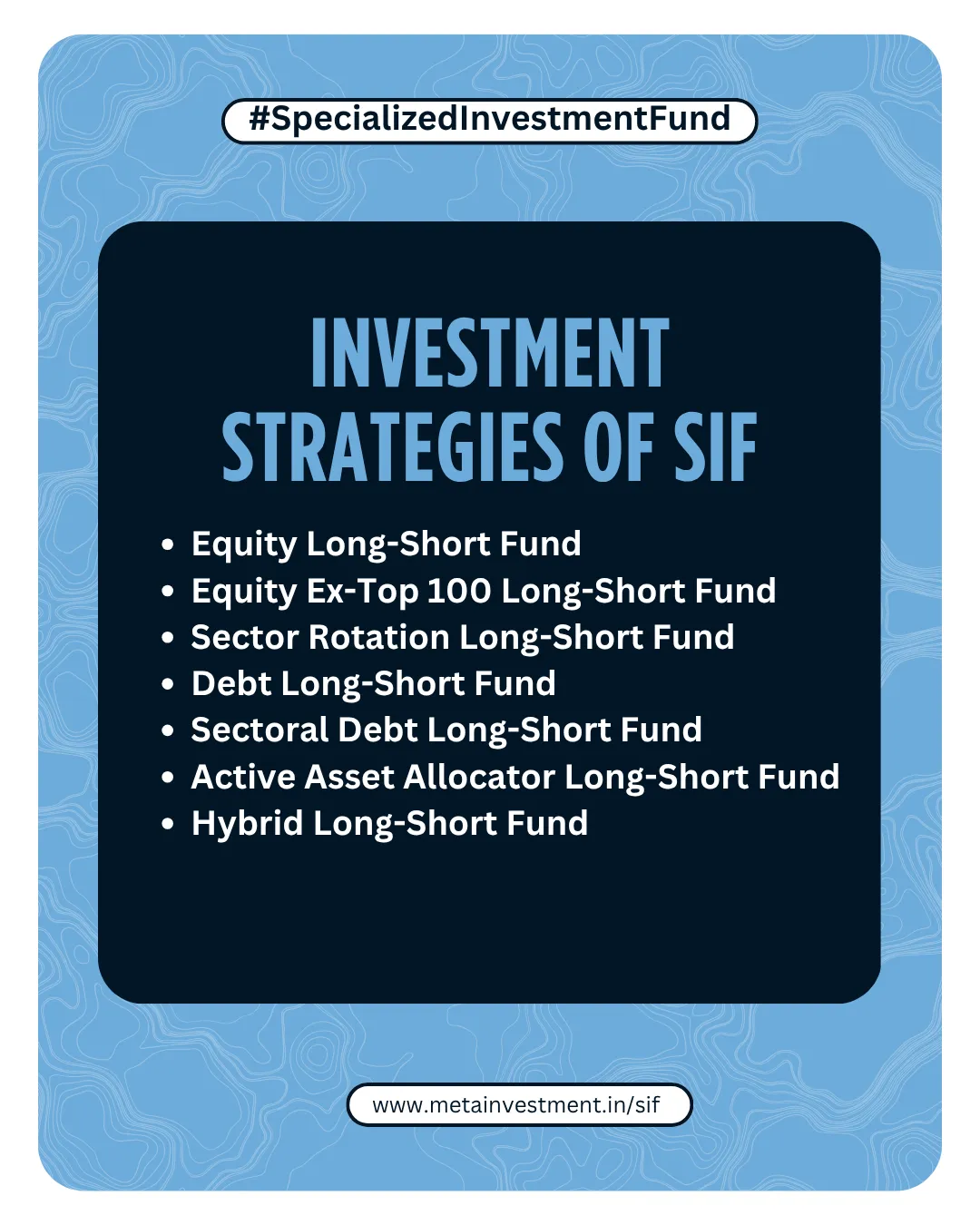

Investment Strategies

SIFs can offer a variety of investment strategies, including equity-oriented, debt-oriented, and hybrid strategies. These strategies can include long-short positions, sector rotation, and dynamic asset allocation.

Minimum Investment Threshold

The minimum investment in SIFs is INR 10 lakhs per investor across all strategies. This threshold does not apply to accredited investors.