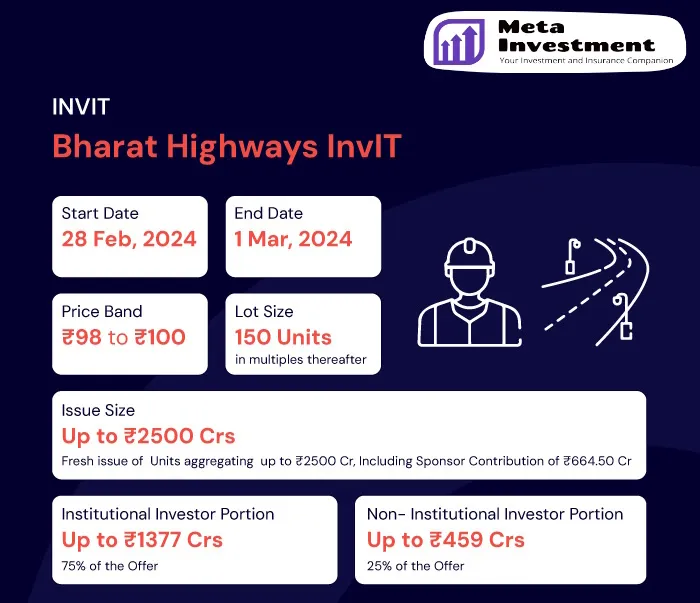

Bharat Highway Invit IPO

Bharat Highways InvIT is an infrastructure investment trust established to acquire, manage and invest in a portfolio of infrastructure assets across sectors and/or securities of companies engaged in the infrastructure sector.

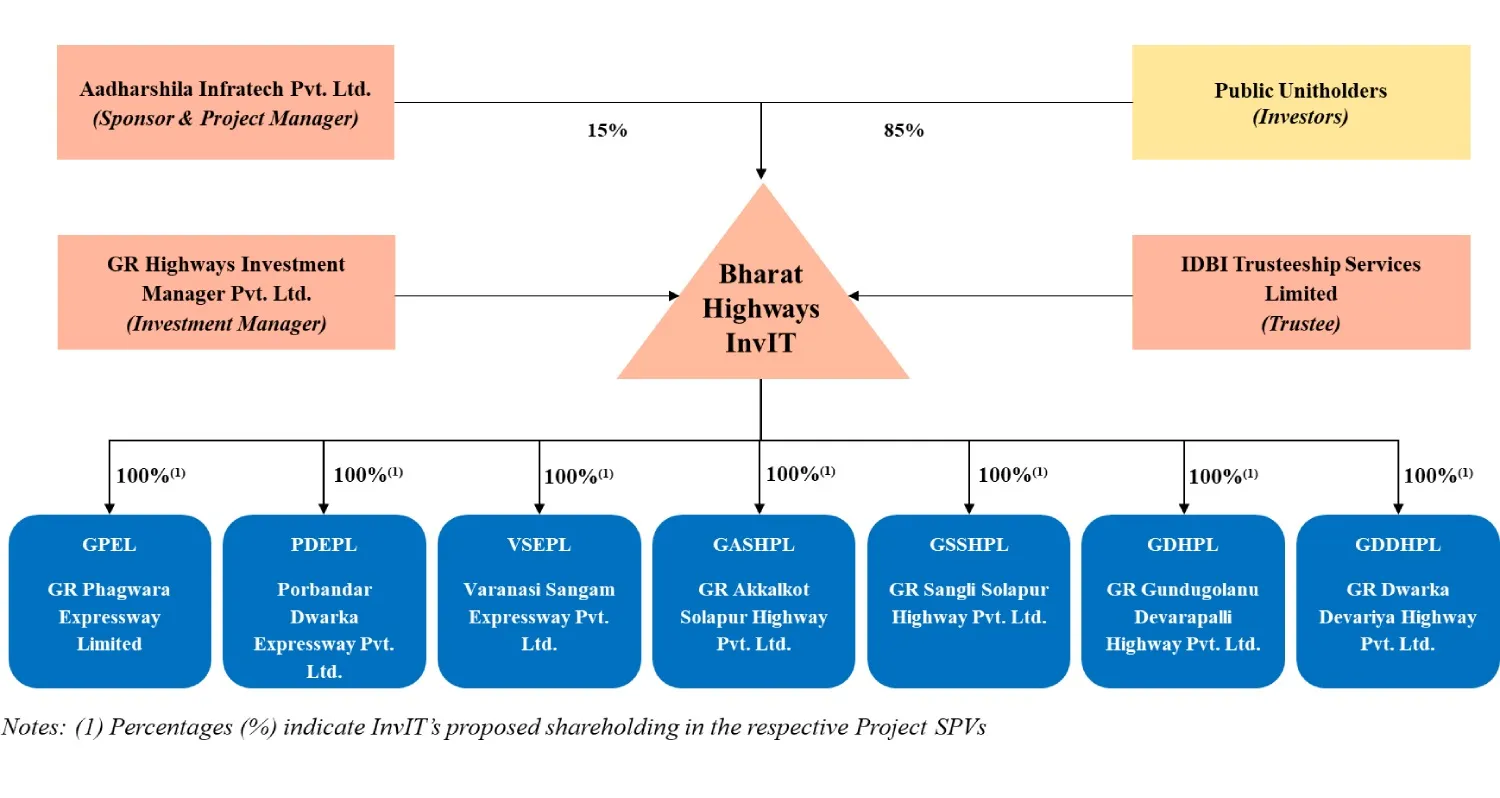

Aadharshila Infratech Private Limited (‘AIPL’) is the Sponsor and the Project Manager of Bharat Highways InvIT. AIPL offers high-quality consulting and laboratory services with the most advanced testing equipment’s, primarily in the field of Transportation Engineering and its allied sectors in India. AIPL carry out these tests under the guidance of their experienced and skilled professionals.

GR Highways Investment Manager Private Limited (‘GRHIMPL’) is the Investment Manager of Bharat Highways InvIT. IDBI Trusteeship Services Limited (the ‘Trustee’) has been appointed as the trustee of the Trust in accordance with the provisions of the InvIT Regulations.

Bharat Highway Invit Issue opens on 28th Feb 2024 and closes on 01 March 2024.

What is InvIT?

Infrastructure Investment Trusts (InvITs) are investment vehicles that pool money from investors to invest in infrastructure projects. Learn more about InvIT

Structure of Bharat InvIT

There are 7 road project at present proposed to be part of this InvIT.

- GR Phagwara Expressway Limited

- Porbandar Dwarka Expressway Private Limited

- GR Gundugolanu Devarapalli Highway Private Limited

- GR Akkalkot Solapur Highway Private Limited

- Varanasi Sangam Expressway Private Limited

- GR Sangli Solapur Highway Private Limited

- GR Dwarka Devariya Highway Private Limited

Who should invest in InvIT?

InvIT are very good way for investors to exposure to big infrasturucter projects and earn steady income. As of today there are 3 listed InvIT’s in India.

- India Grid Trust issue price was at 100

- Power Grid Trust

- IRB InvIT Fund

India Grid Trust issue price was at ₹100 per unit when it got listed on June 6, 2017 and as of today (1 March 2024) its trading in the range of ₹133 per unit. Cummulatively Indigrid has done distribution of ₹82.41 . This translates in to above 15% XIRR over the period of 6-7 years. Gross pre tax distribution yield for Indigrid is around 12%.

This Bhart InvIt earns its income directly from NHAI and is not dependent on toll collection. So the distribution is expected to be consistent. All the road projects have more than 12 years of visible income generation pipeline.

So if you are looking for steady returns this InvtIT may be good option for you to consider parking your money.

(Updated: )