Edelweiss is one of India’s leading financial services conglomerates having presense in multiple lines of businesses.

Edelweiss Financial Services Limited (“EFSL”), was incorporated on November 21, 1995 under the name Edelweiss Capital Limited and started operations as an investment banking firm after receipt of a Category II license from SEBI. Edelweiss Capital Limited subsequently received a Category I Merchant Banker license from SEBI with effect from October 16, 2000. The name of Edelweiss Capital Limited was changed to ‘Edelweiss Financial Services Limited’ with effect from August 1, 2011.

Edelweiss Financial Services Limited (“EFSL”), was incorporated on November 21, 1995 under the name Edelweiss Capital Limited and started operations as an investment banking firm after receipt of a Category II license from SEBI. Edelweiss Capital Limited subsequently received a Category I Merchant Banker license from SEBI with effect from October 16, 2000. The name of Edelweiss Capital Limited was changed to ‘Edelweiss Financial Services Limited’ with effect from August 1, 2011.

Key lines of business of Edelweiss are

- Retail Credit (Home Loans, SME and Business Loans)

- Asset Management (Mutual Funds and Alternative Assets)

- Asset Reconstruction

- Insurance (Life, General)

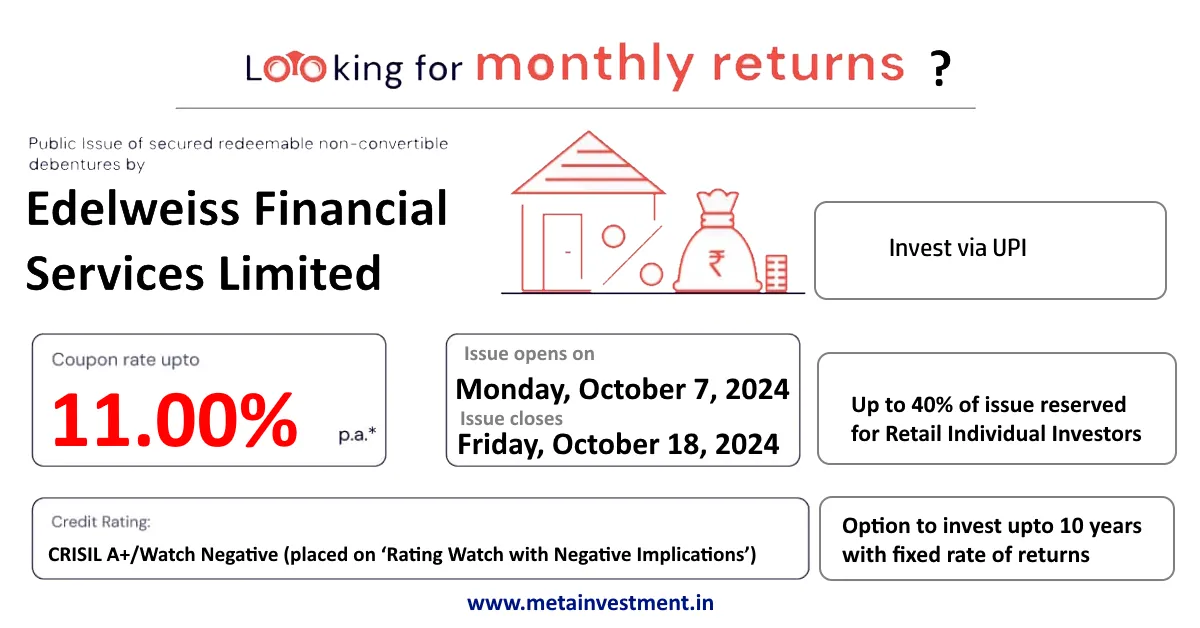

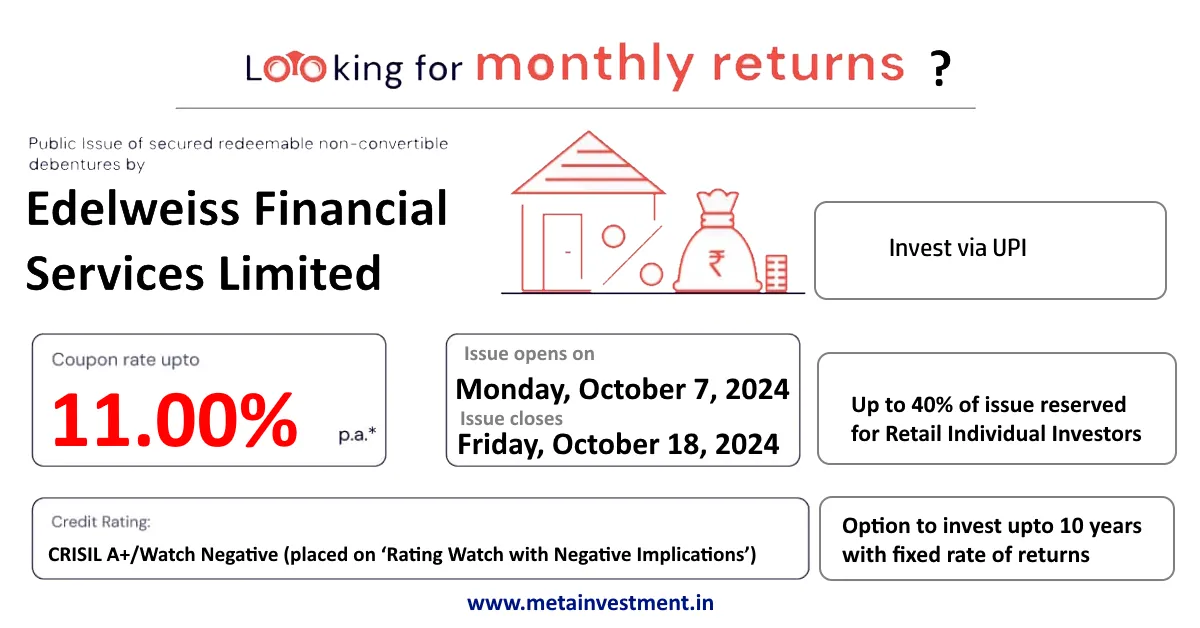

Key Features of the NCD issue

-

Issuer: Edelweiss Financial Services Limited

-

Issue Opens On: Monday, October 7, 2024

-

Issue Close On: Friday, October 18, 2024

-

Tenure: Multiple options available, ranging from 2 years (24 months) to 10 years (120 months).

-

Credit Rating: The NCDs have received credit ratings of A+ by CARE Ratings Limited, indicating their creditworthiness.

-

Minimum Investment: The minimum investment amount is ₹10,000, making it accessible to a wider range of investors.

-

Lead Manager: Nuvama Wealth Management Limited, , Trust Investment Advisors Private Limited and Tipsons Consultancy Services Private Limited

-

Total Issue Size: ₹200 crores

-

Base Issue Size: ₹100 crores

-

Listing: The NCDs are proposed to be listed on BSE. The NCDs shall be listed within 6 (six) Working Days from the Issue Closing Date. BSE has been appointed as the Designated Stock Exchange.

-

Pay via UPI: Retail investors can invest online upto ₹5 Lakhs using UPI id.

-

Interest Rates: Varying interest rates depending on the chosen option and investor category (retail or institutional). Check the table below.

Monthly Interest Payment Frequency

| Tenure (Months) | 36 | 60 | 120 |

| Coupon | 9.57% | 10.04% | 10.49% |

| Effective Yield | 9.65% | 10.51% | 11.00% |

Yearly Interest Payment Frequency

| Tenure (Months) | 24 | 36 | 60 | 120 |

| Coupon | 9.50% | 10.00% | 10.50% | 11.00% |

| Effective Yield | 9.50% | 10.00% | 10.50% | 11.00% |

Cumulative Payment

| Tenure (Months) | 24 | 36 | 60 |

| Effective Yield | 9.50% | 10.00% | 10.50% |

Staggered Redemption

| Tenure (Months) | 60 | 120 |

| Coupon | 10.50% | 10.00% |

| Effective Yield | 10.50% | 10.99% |

| Partial Redemption | Staggered Redemption in Three (3) annual payments of ₹250.00 each in 3rd and 4th Anniversary and ₹ 500.00 on 5th Anniversary* | Staggered Redemption in Five (5) annual payments of ₹ 200 each, starting from 6th Anniversary* until Maturity |

Should You Invest?

Edelweiss NCDs can be an attractive option for investors seeking stable returns and regular income. The interest rates offered are often higher than those of traditional fixed deposits, making them appealing in the current low-interest-rate environment. Also considering global interest rate cycle is now moving downwards, we might not see new issues offering this kind of interest rates.

However, it’s important to consider a few factors before investing:

-

Credit Risk: Although the Edelweiss Group has a strong track record, it’s crucial to assess the credit rating of the NCDs and understand the associated risks.

-

Interest Rate Risk: If interest rates rise in the future, the value of your NCDs could decline in the secondary market.

-

Liquidity: While NCDs can be traded in the secondary market, liquidity might be limited compared to other debt instruments.

Who Should Consider Investing?

-

Risk-averse investors looking for stable returns and regular income.

-

Investors seeking higher interest rates than those offered by traditional fixed deposits.

- Investors looking to diversify their fixed-income portfolio.

How to Invest?

Meta Investment offers complete online investing in this NCD. Connect with us for more details.

Conclusion

Edelweiss NCDs present an opportunity to earn fixed returns in a volatile market scenario. However, it’s essential to evaluate the risks and your investment goals before making a decision. If you’re unsure, consult a financial advisor to assess whether Edelweiss NCDs fit your investment strategy.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in NCDs involves risks, and investors should carefully evaluate the offer document before making any investment decisions.

Edelweiss Financial Services Limited (“EFSL”), was incorporated on November 21, 1995 under the name Edelweiss Capital Limited and started operations as an investment banking firm after receipt of a Category II license from SEBI. Edelweiss Capital Limited subsequently received a Category I Merchant Banker license from SEBI with effect from October 16, 2000. The name of Edelweiss Capital Limited was changed to ‘Edelweiss Financial Services Limited’ with effect from August 1, 2011.

Edelweiss Financial Services Limited (“EFSL”), was incorporated on November 21, 1995 under the name Edelweiss Capital Limited and started operations as an investment banking firm after receipt of a Category II license from SEBI. Edelweiss Capital Limited subsequently received a Category I Merchant Banker license from SEBI with effect from October 16, 2000. The name of Edelweiss Capital Limited was changed to ‘Edelweiss Financial Services Limited’ with effect from August 1, 2011.