The National Pension System NPS has become a popular option for long-term savings, especially for those seeking a tax-efficient way to build their retirement corpus. But how has NPS performed in last decade? Let’s delve into the data and see how it stacks up.

Government Backing

The NPS is backed by the Government of India, providing an added layer of security and stability to your retirement savings.

Who Should Consider NPS?

NPS is a suitable option for individuals seeking a long-term, disciplined approach to retirement planning. It’s particularly beneficial for:

-

Salaried Individuals: Salaried individuals can opt for employer contributions to their NPS account, further boosting their retirement corpus.

-

Self-Employed Individuals: For self-employed individuals, NPS provides a structured way to save for retirement and avail tax benefits.

-

Young Investors: Starting early with NPS allows you to benefit from the power of compounding and build a substantial corpus over the long term.

A Decade of Steady Returns

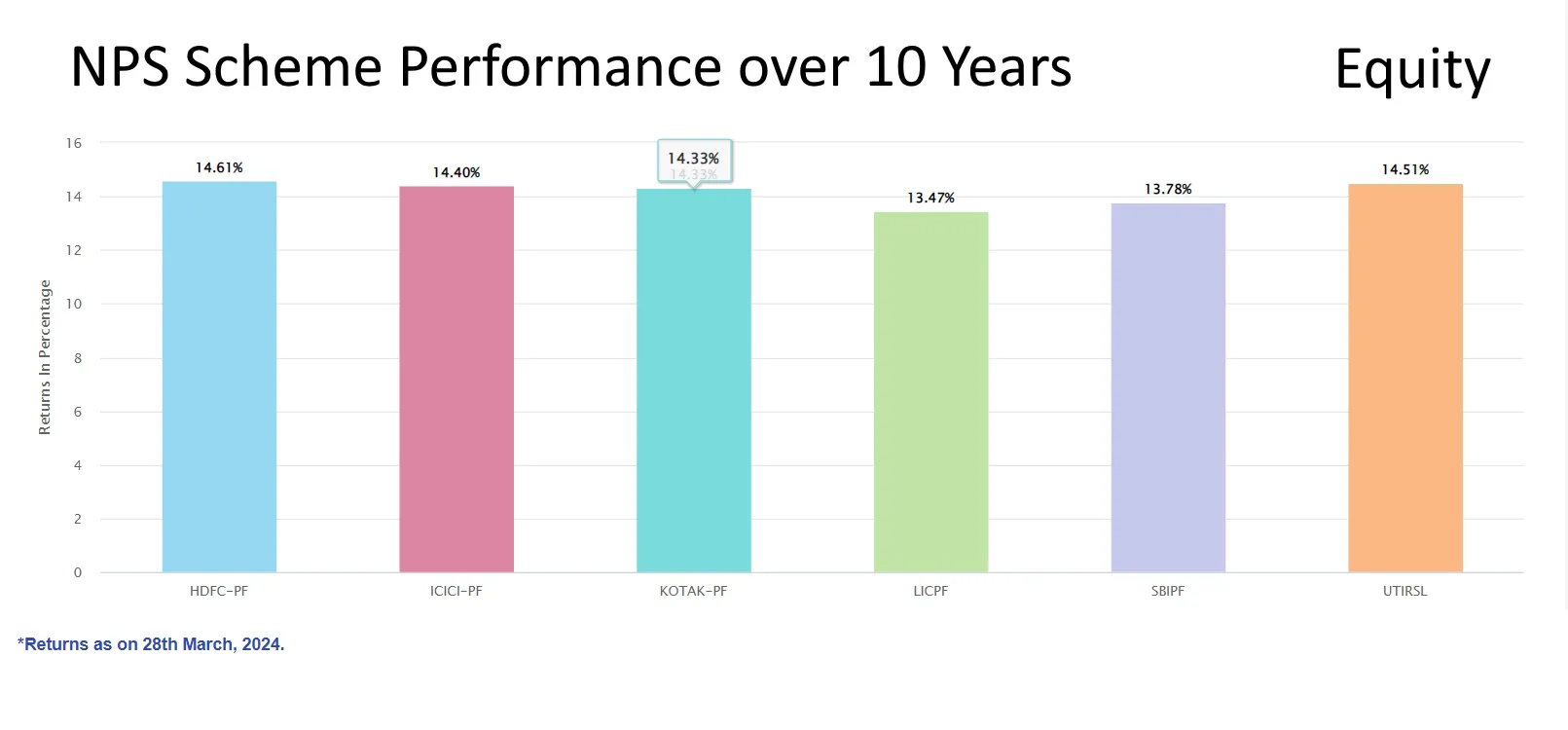

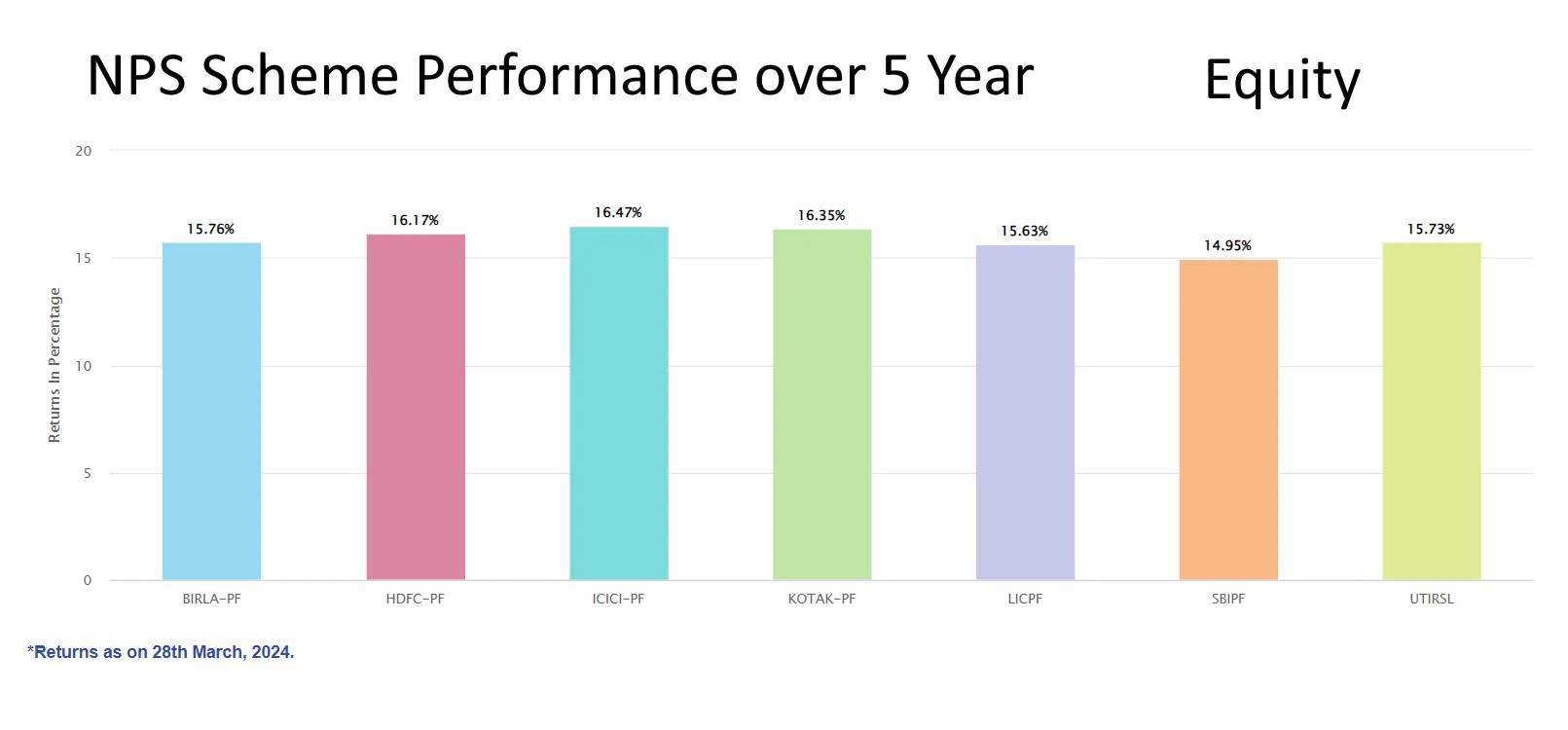

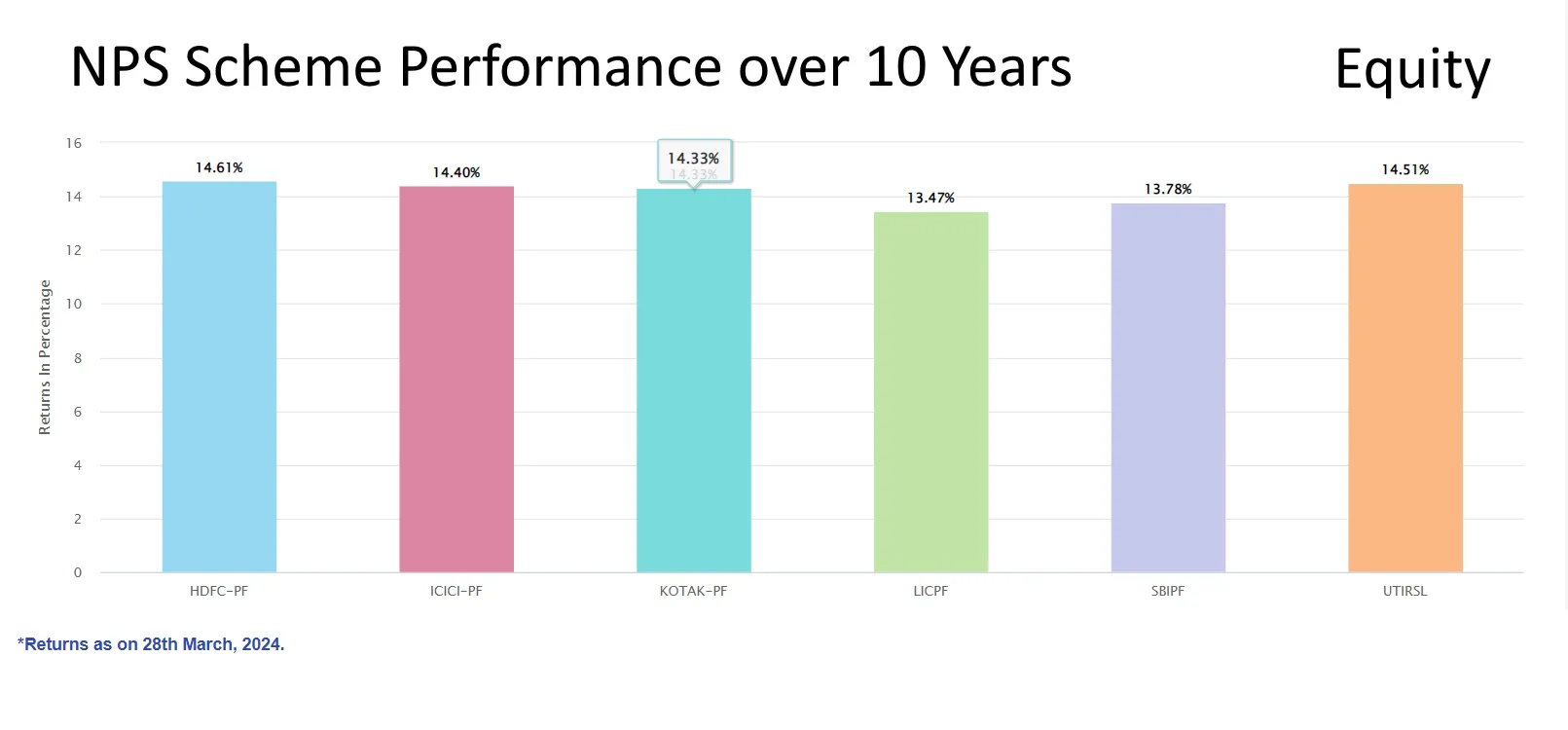

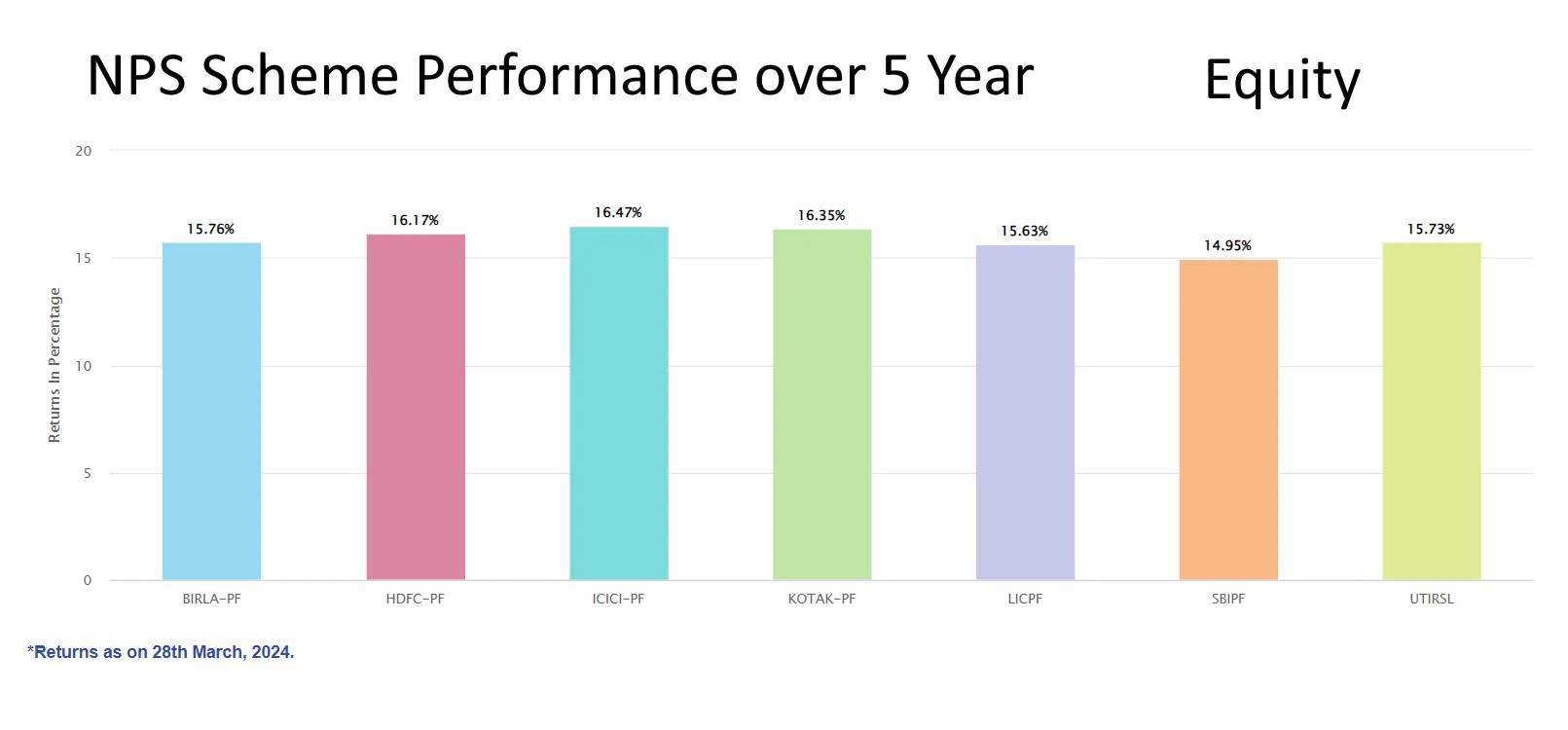

Looking at the past 10 years (as of March 2024), NPS Equity schemes from various NPS fund managers have delivered consistent returns, ranging from 13.47% to 14.61% . This compares favorably to traditional fixed-income options like fixed deposits or Public Provident Funds (PPFs), which typically offer lower returns in the range of 6-8%.

Here’s a graph summarizing the average returns of different NPS fund managers in the equity schemes over the past 10 years.

As the graph below shows equity schemes of all NPS Fund managers were able to generate more than 14% returns.

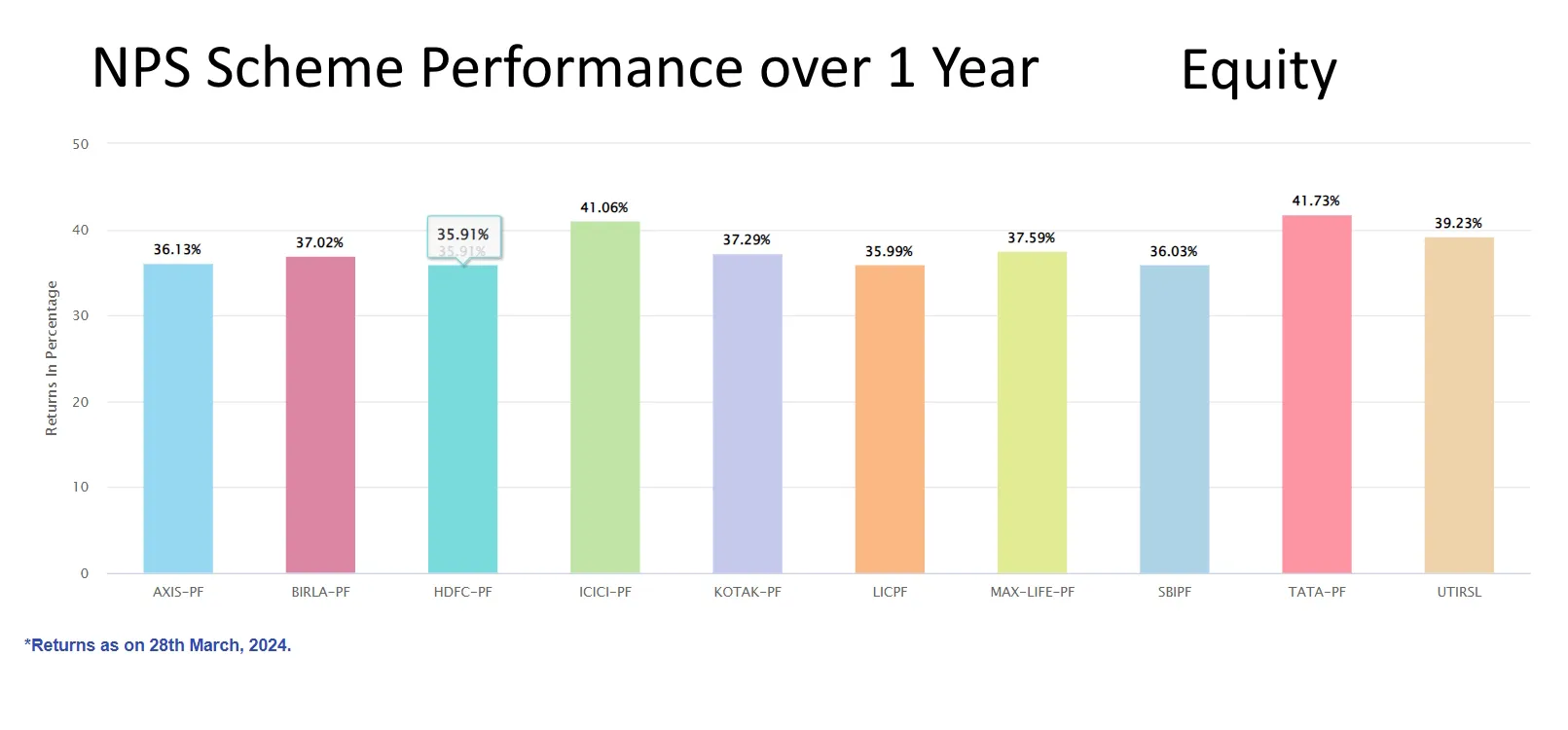

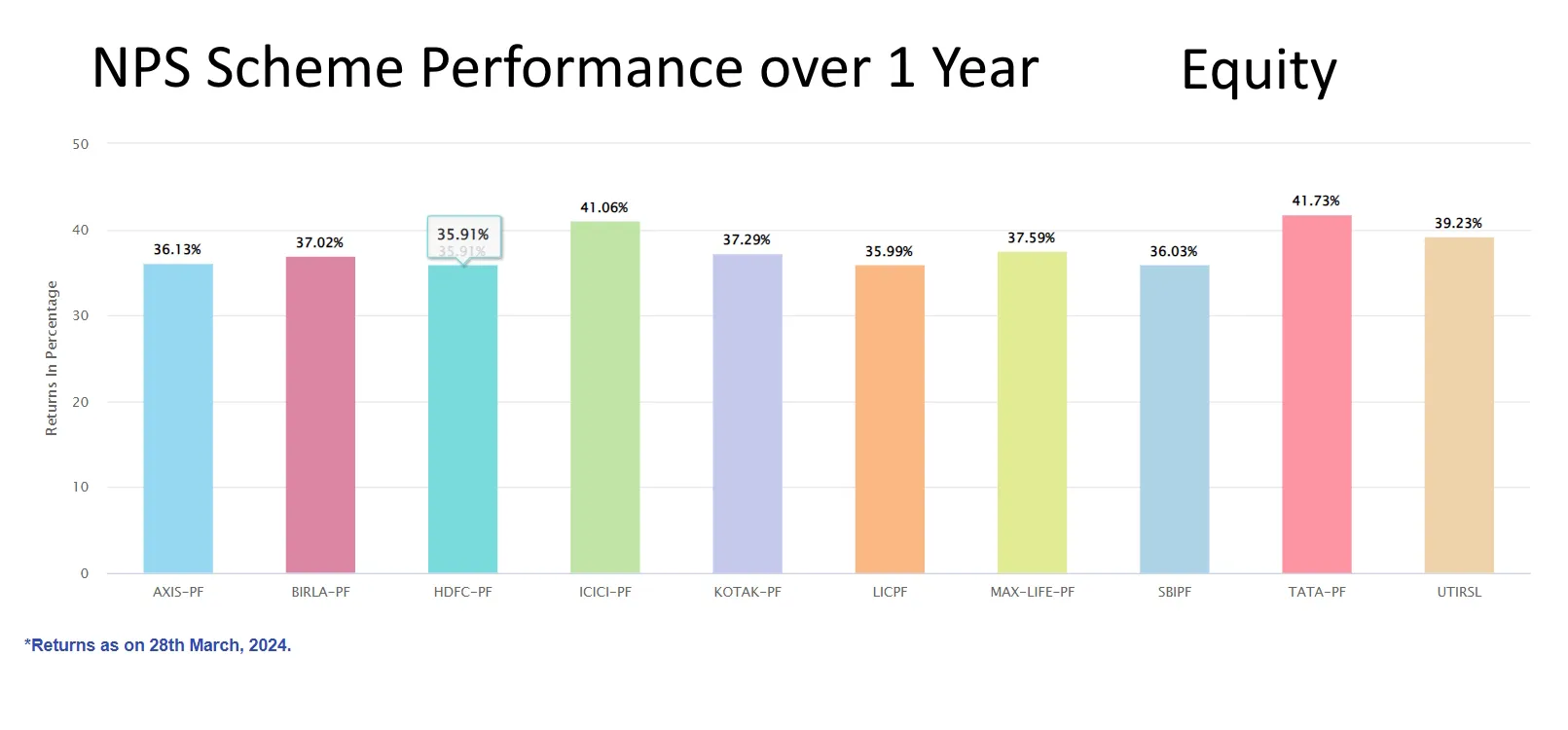

Equity markets in India have given steller returns in last one year and same is also reflected in the performance of equity schemes from all fund managers of NPS.

Market Fluctuations and Long-Term Focus

It’s important to remember that these are average returns, and the actual performance can fluctuate year-on-year depending on market conditions. NPS equities contributions are inherently subject to market volatility. However, NPS is designed for the long haul (minimum investment horizon until 60 years of age). Over extended periods, equity markets tend to outperform other asset classes, potentially leading to higher overall returns for your retirement corpus.

Benefits Beyond Returns

While returns are crucial, NPS offers other advantages for retirement planning:

-

Tax Benefits: Contributions to NPS qualify for tax deductions under Section 80CCC of the Income Tax Act. Also, an exclusive 50 thousand contribution can claimed for tax deduction under section 80D. Additionally, on maturity, 60% of the corpus is tax-free.

-

Flexibility with Asset Allocation: NPS allows you to choose your investment mix based on your risk tolerance. You can opt for a more aggressive equity allocation for potentially higher returns or a more conservative approach with a focus on government bonds.

-

Professional Management: NPS funds are managed by experienced fund managers, ensuring diversification and adherence to investment best practices.

Consulting a Retirement Advisor

While NPS has a strong track record, it’s not a one-size-fits-all solution. Consulting a professional to determine if NPS is the right fit for your individual needs and financial goals. We can help you:

-

Assess your retirement needs: We can help you calculate the corpus you’ll need to maintain your desired lifestyle after retirement.

-

Choose the right NPS scheme: Based on your risk tolerance and investment horizon, we can recommend the most suitable NPS scheme for you.

-

Develop a comprehensive retirement plan: NPS can be a part of a broader retirement planning strategy that may include other investments and social security benefits.

Looking Ahead: The Next 10 Years of NPS

The future performance of NPS will depend on various factors, including market conditions, economic growth, and regulatory changes. However, the consistent returns delivered over the past decade are encouraging. With its focus on long-term investing, tax benefits, and professional management, NPS remains a compelling option for building a secure and comfortable retirement.

Ready to Start Planning?

If you’re considering NPS and want to learn more about how it fits into your overall retirement strategy, feel free to reach out to us for a personalized consultation. Together, we can build a secure and comfortable future for your golden years.

Data source https://npstrust.org.in/