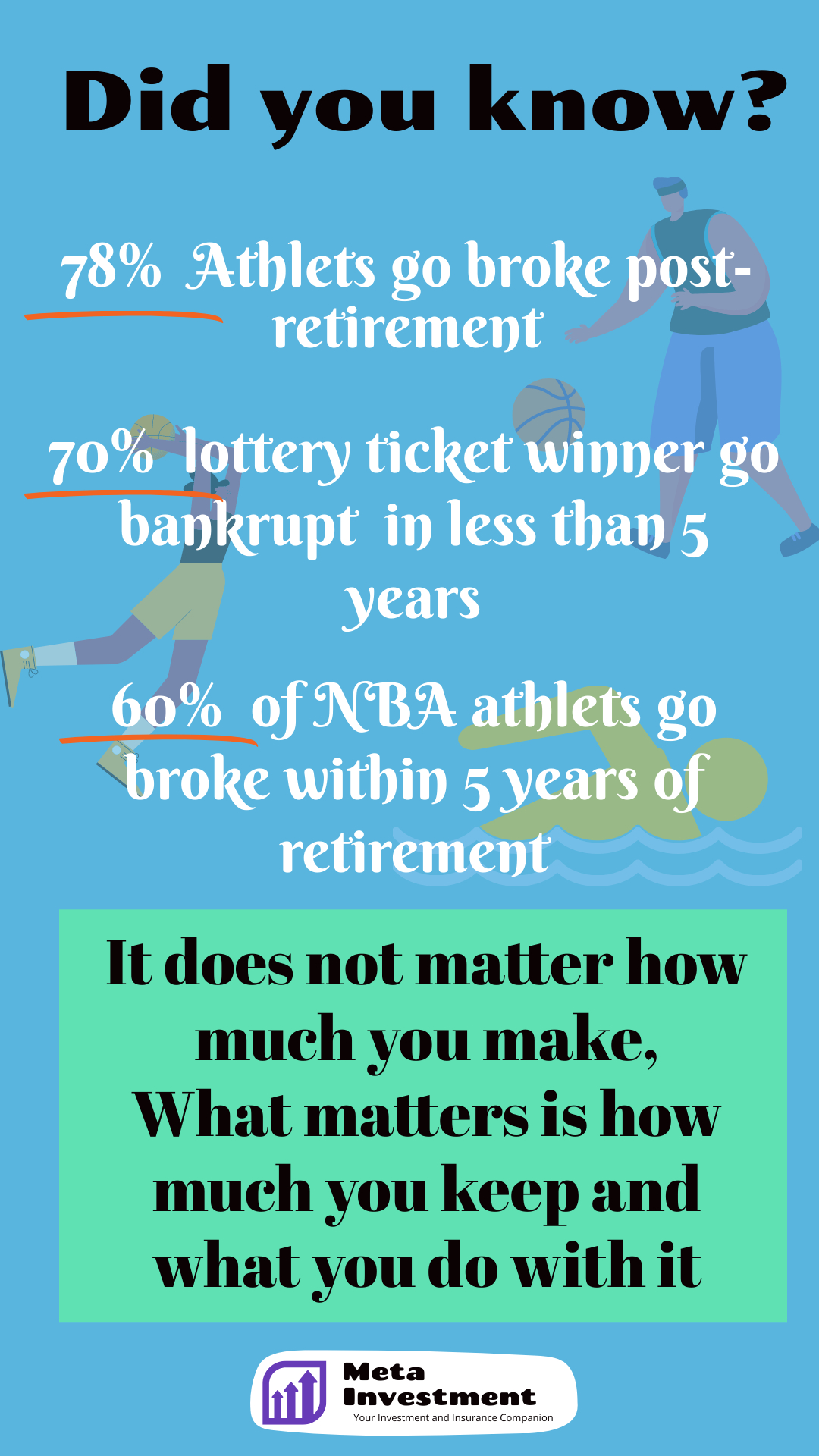

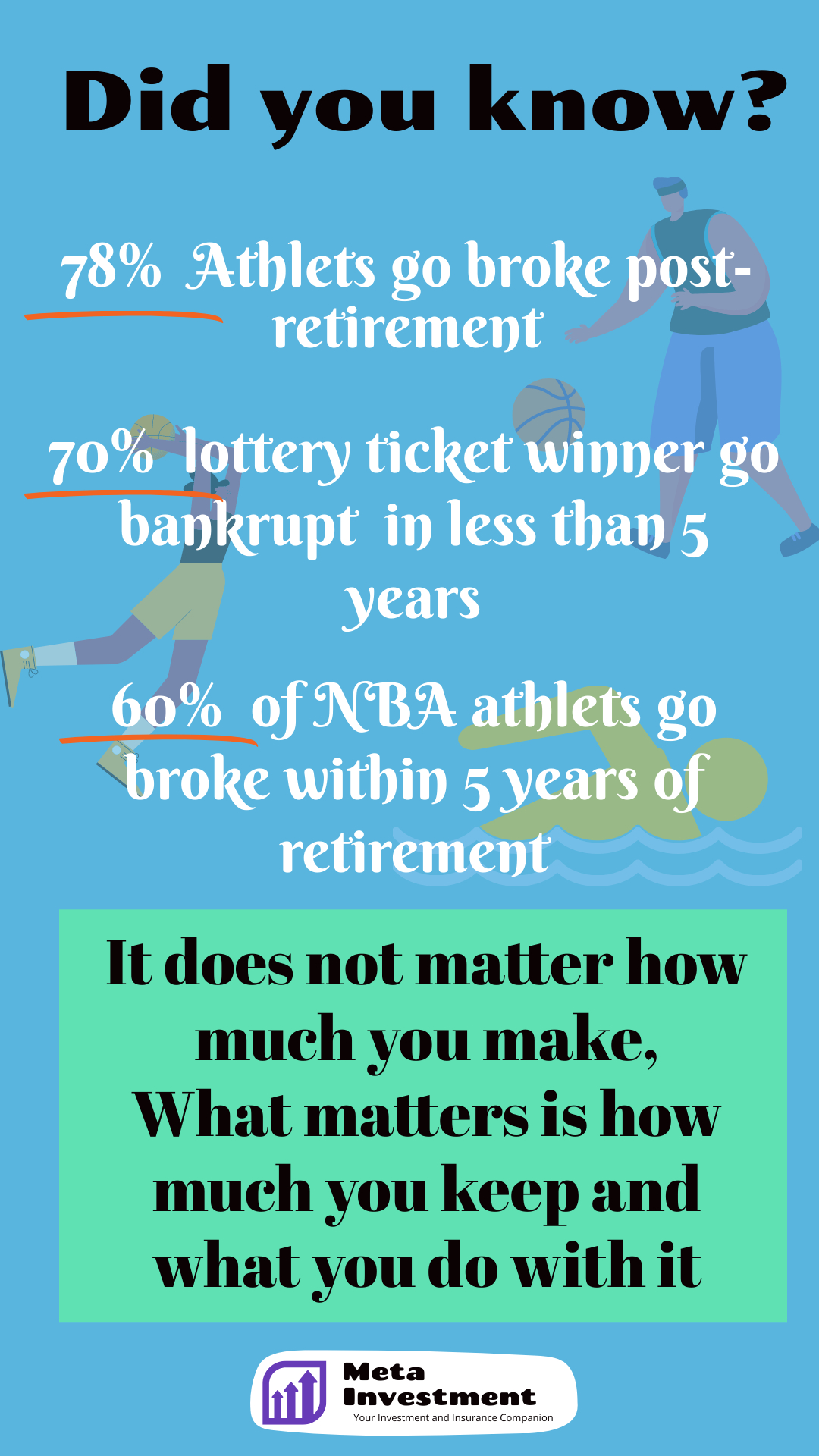

78% of Athlets go broke within 2 years of retirement !

70% of lottery ticket winners go bankrupt in less than 5 years !!

70% of lottery ticket winners go bankrupt in less than 5 years !!

60% NBA athlets go broke within 5 years of retirement !!!

It does not matter how much you make. What matters is how much you keep and what you do with it.

Investment is an essential component of financial planning that allows individuals to grow their wealth and secure their future. However, the importance of investment is often underestimated, and many people fail to realize the potential benefits of investing their money. Unfortunately, there are countless examples of individuals, including Indian sportspeople, celebrities, and lottery winners, who have faced bankruptcy due to mismanagement of their funds.

One such example is former Indian cricketer Mohammad Azharuddin, who earned a substantial amount of money during his career but declared bankruptcy in 2010. Despite earning over $5 million in prize money and endorsements, Azharuddin was unable to manage his finances properly, and his extravagant lifestyle and poor investments led to his financial downfall.

Another example is Bollywood actor Shiney Ahuja, who faced financial troubles after a lack of work in the film industry. He reportedly invested heavily in a real estate project that failed, leading to his financial ruin.

Sushil Kumar who was winner of fifth season of Kaun Banega Crorepati had won Rs. 5 crores. But he then took many risky bets without proper vision and saw his all wealth disappear along with lot much hardship in personal life as well.

Furthermore, in 2011, Indian lottery winner Udayakumar faced a similar fate after winning a substantial amount of money but was unable to manage his finances properly. He reportedly invested in risky ventures without fully understanding the risks involved, leading to his financial downfall.

These examples highlight the importance of investment and proper financial planning. While earning a large sum of money is undoubtedly a significant accomplishment, it is equally important to manage that money wisely. Investing a portion of one’s earnings in a diverse range of assets, such as stocks, bonds, and real estate, can help individuals grow their wealth and secure their financial future.

Data from the National Stock Exchange of India shows that investing in the Indian stock market has historically yielded significant returns. Between 2000 and 2020, the average annual return for the NIFTY 50 index was 10.5%, significantly higher than the average savings account interest rate. Over the same period, the value of a rupee invested in the NIFTY 50 grew to over Rs. 7, while the same rupee invested in a savings account would have only grown to Rs. 2.

In addition to the potential for high returns, investing also helps individuals protect their wealth from inflation. Inflation refers to the rate at which prices for goods and services increase over time, reducing the purchasing power of one’s money. Investing in assets that appreciate in value at a rate higher than inflation can help individuals maintain and even increase their purchasing power over time.

In conclusion, the importance of investment cannot be overstated. While earning a large sum of money is a significant accomplishment, it is equally important to manage that money wisely. Investing a portion of one’s earnings in a diverse range of assets can help individuals grow their wealth and secure their financial future. The examples of Mohammad Azharuddin, Shiney Ahuja, Sushil Kumar, and Udayakumar serve as cautionary tales and remind us of the importance of proper financial planning and investment.

70% of lottery ticket winners go bankrupt in less than 5 years !!

70% of lottery ticket winners go bankrupt in less than 5 years !!