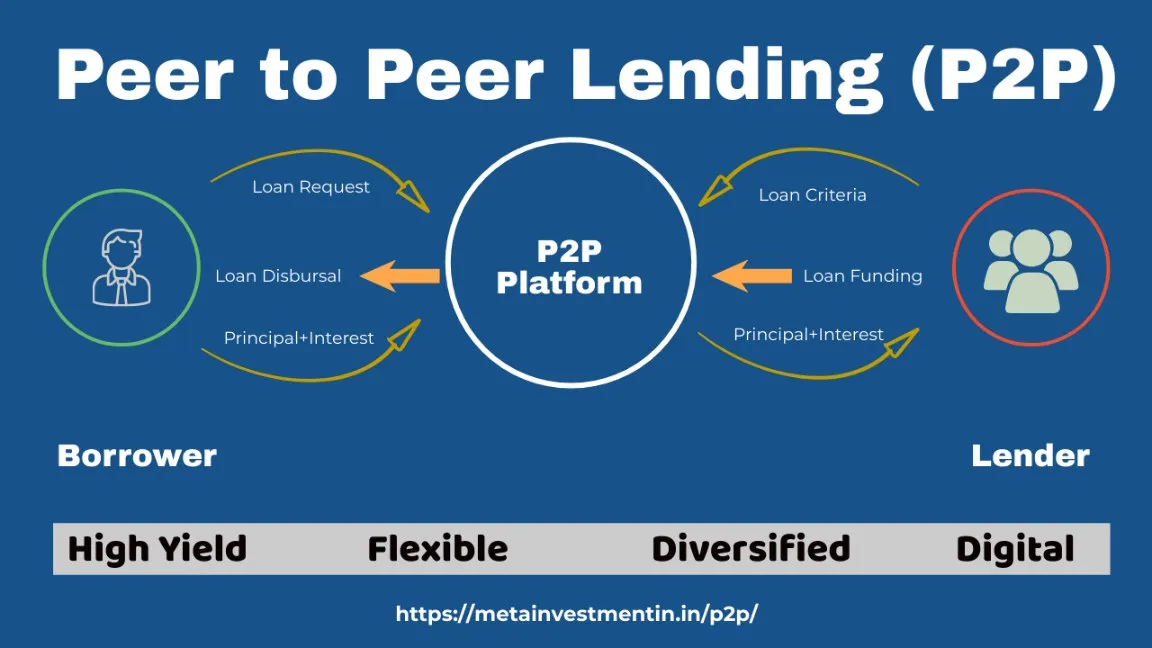

Peer to Peer (P2P) lending is a relatively new concept in India, which has gained popularity in recent years. It is an online lending platform that connects borrowers and lenders directly without any involvement from traditional financial institutions like banks. These various lending platforms are regulated by RBI (Reserve Bank of India) under NBFC-P2P guidelines. As lenders lend money directly to the borrowers it results in less expensive loans for borrowers but at the same time, better risk-adjusted returns for investors. P2P lending platforms use sophisticated algorithms and data analytics to match borrowers with investors based on their creditworthiness, risk profile, and other relevant factors.

Peer to Peer (P2P) lending is a relatively new concept in India, which has gained popularity in recent years. It is an online lending platform that connects borrowers and lenders directly without any involvement from traditional financial institutions like banks. These various lending platforms are regulated by RBI (Reserve Bank of India) under NBFC-P2P guidelines. As lenders lend money directly to the borrowers it results in less expensive loans for borrowers but at the same time, better risk-adjusted returns for investors. P2P lending platforms use sophisticated algorithms and data analytics to match borrowers with investors based on their creditworthiness, risk profile, and other relevant factors.

Benefits of P2P Lending in India

Access to Credit P2P lending platforms provide access to credit to individuals who are unable to obtain loans from traditional financial institutions like banks. This is especially true for borrowers with poor credit scores or no credit history. P2P lending platforms use alternative credit scoring models to evaluate a borrower’s creditworthiness, which allows them to offer loans to a broader range of borrowers.

Lower Interest Rates P2P lending platforms offer loans at lower interest rates than traditional financial institutions like banks. This is because they have lower overhead costs and do not have to maintain physical branches or employ a large workforce. Lower interest rates make borrowing more affordable and can help borrowers save money on interest payments.

Diversification of Investments P2P lending platforms provide an opportunity for investors to diversify their investments by investing in a range of loans with varying risk profiles. This diversification helps investors to spread their risk and reduce the impact of defaults on their overall portfolio.

Challenges of P2P Lending in India

Lack of Regulation P2P lending is a new concept in India, and there is no specific regulation governing its operations. While the Reserve Bank of India (RBI) has issued guidelines for P2P lending platforms, there is no specific regulatory framework for the industry. This lack of regulation creates a risk for both borrowers and lenders.

Default Risk P2P lending involves lending money to individuals who may not have a strong credit history or may have a high risk of default. This default risk can lead to losses for lenders who invest in such loans. P2P lending platforms try to mitigate this risk by using sophisticated algorithms and data analytics to evaluate a borrower’s creditworthiness.

P2P Lending Eligibility

As per RBI’s directives, an entity with valid KYC documents (PAN Card, Address Proof, Indian Bank Account, Email Id & Mobile No.) can lend via a Peer-to-Peer Platform. Eligible Entities include:

- Individual (18 years old or above)

- HUF

- Corporate (Incorporated under Indian Companies Act or RBI Listed Finance Companies)

- Partnership Firm

- Limited Liability Partnership (LLP)

- Body of Individuals

- Society

- Artificial Body

How much I can invest/borrow on P2P platforms?

Any individual entity can lend up INR. 50 lakhs across all P2P lending platforms, where as it can borrow loans up to 10 lakhs INR.

How to get started?

P2P lending is a new and innovative concept in India that offers an alternative source of credit to borrowers who are unable to obtain loans from traditional financial institutions. The industry is still evolving, and there are challenges to its growth, including lack of regulation and default risk. However, P2P lending has the potential to revolutionize the lending industry in India by providing affordable credit to a wider range of borrowers and offering investors an opportunity to diversify their investments. As the industry matures and gains wider acceptance, it has the potential to become a significant player in the Indian financial ecosystem.

To understand more about P2P lending/borrowing you can contact us over phone/email/WhatsApp.

LIQUILOANS is one major CRISIL assessed P2P platform. To register with LiquiLoan as invester click here and follow simple instructions.