The Indian stock market has witnessed impressive growth in recent years, with large-cap companies leading the charge. While the BSE Largecap Index delivered solid returns in 2024, analysts suggest that valuations in mid and small-cap segments may remain elevated. This presents an opportune moment to consider investing in large-cap companies with strong growth potential.

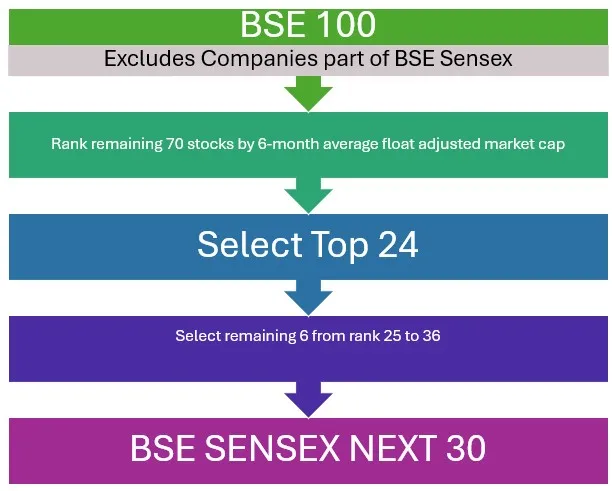

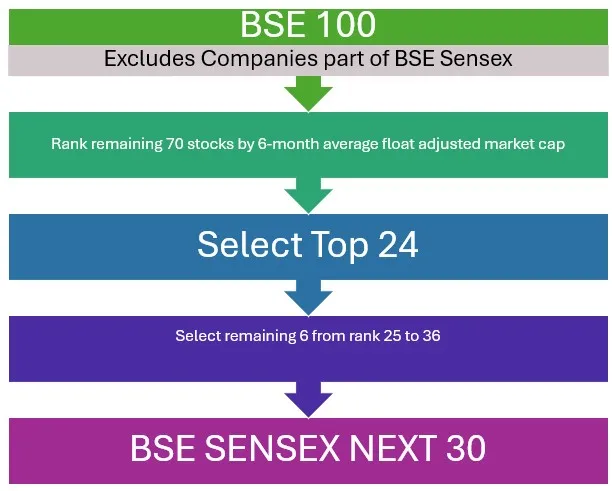

To cater to this need, DSP Mutual Fund has launched the DSP BSE SENSEX NEXT 30 INDEX FUND, an open-ended scheme replicating/tracking the BSE SENSEX Next 30 Index. This unique index captures the next 30 largest and most liquid companies within the BSE 100 after the BSE Sensex, offering exposure to a distinct segment of India’s corporate landscape.

Why Invest in DSP BSE SENSEX NEXT 30 INDEX FUND?

-

Unique Exposure: This fund provides access to a unique set of large-cap companies not fully represented by major benchmarks like the Nifty 50 and Nifty Next 50.

-

Growth Potential: Historically, the BSE Sensex Next 30 Index has exhibited a higher risk, higher return profile compared to the Nifty 50 and BSE Sensex.

-

Diversification: The index offers a balanced sectoral diversification with lower concentration in financial services compared to major benchmarks.

-

Cost-Effective: As an index fund, it offers a cost-effective way to invest in a diversified basket of large-cap companies.

-

Potential for Future Leaders: The index includes promising companies that have the potential to become future market leaders. In the past decade, 20 stocks have transitioned from the BSE Sensex Next 30 to the Sensex 30.

Rebalacing of Index

As an index-based fund, the scheme will closely track the constituents of the “BSE SENSEX NEXT 30 INDEX” This index is maintained by Asia Index Pvt. Ltd., a wholly-owned subsidiary of BSE India Ltd. The index will be rebalanced twice annually in June and December. Index constituents are weighted based on their free-float market capitalization. The BSE SENSEX NEXT 30 Index was launched on August 5, 2024, with a base date of June 20, 2014.

On a 3-year rolling return basis, this index has provided 14.5% returns. A lump sum investment of ₹1 lakh at the inception of the fund would have grown to ₹4.5 lakh, resulting in a CAGR of 15.6%. An SIP of ₹10,000 since inception in this index would have generated wealth of ₹32.1 lakh, with a CAGR of 17%.

Minimum Investment

One can start investing in this fund with as low as ₹ 100 and in multiple ₹ 100. Alternatively you can register SIP also with ₹ 100 for 12 instalments.

Fund Managers

Anil Ghelani

Total work experience of 27 years.

Diipesh Shah

Total work experience of 23 years.

Who is this fund suitable for?

This fund is suitable for investors seeking:

- Diversification within their large-cap portfolio.

- Exposure to a unique set of large-cap companies with growth potential.

- Cost-effective and passive investment options.

Important Note:

The New Fund Offer (NFO) for the DSP BSE SENSEX NEXT 30 INDEX FUND is closing soon on January 24, 2025. However, as this is an open-ended fund, investors will also have the opportunity to invest in this fund once it becomes open for subscription.