Introduction to Asset Allocation

Asset allocation is the process of dividing investments among different asset classes such as stocks, bonds, real estate, and commodities. The objective is to create a diversified portfolio that balances risk and return based on an individual’s financial goals, risk tolerance, and time horizon.

Understanding Sovereign Gold Bonds (SGBs)

Sovereign Gold Bonds (SGBs) are government securities denominated in grams of gold. These bonds are issued by the Reserve Bank of India (RBI) on behalf of the Government of India. SGBs offer investors the opportunity to invest in gold without the need for physical ownership. The bonds have a tenure of 8 years and carry an annual interest rate payable semi-annually. SGBs are denominated in multiples of gram(s) of gold with a basic unit of one gram. An individual can subscribe for SGBs up to 4 Kg in a financial year. This 4 Kg limit is applicable for purchase of SGBs from secondary market ( stock exchange) as well. As of 9th June, 2023 there are around 10,13,24,182 units (in grams) of SGBs issued by RBI. Considering current spot price of Gold at ₹5510/- this translates to around ₹55,829.62 Crores.

Benefits of Investing in SGBs

Safety and Security: SGBs are backed by the Government of India, providing a high level of safety and security to investors.

No Storage Hassles: Unlike physical gold, SGBs eliminate the need for storage and security concerns.

Regular Income: SGBs offer a fixed annual interest rate, providing investors with a regular income stream in addition to potential capital appreciation.

Capital Appreciation: SGBs track the market price of gold, allowing investors to benefit from price appreciation.

Tax Efficiency: Long-term capital gains on SGBs are tax-exempt if held until maturity. Also, the indexation benefits will be provided to long term capital gains arising to any person on transfer of the SGB.

Collateral : The SGBs can be used as collateral for loans. The loan-to-value (LTV) ratio will be as applicable to any ordinary gold loan, mandated by the Reserve Bank from time to time.

Factors to Consider for Asset Allocation with SGBs

When allocating assets to SGBs, it is important to consider the following factors:

- Financial Goals and Risk Profile

Identify your financial goals, such as wealth accumulation, retirement planning, or funding for specific milestones. Assess your risk tolerance to determine the proportion of assets to allocate to SGBs.

- Time Horizon

Consider the time horizon for your investment goals. SGBs have a fixed tenure of 8 years, so they may be suitable for long-term goals.

- Market Conditions

Analyze the market conditions and outlook for gold prices. SGBs are linked to the market price of gold, so it is essential to evaluate the potential for capital appreciation.

- Portfolio Diversification

Diversification is key to managing risk. Assess your existing portfolio and determine the appropriate allocation to SGBs to achieve diversification benefits.

Determining the Allocation Percentage

The allocation percentage to SGBs will vary based on individual preferences and financial circumstances. However, it is generally recommended to allocate a portion of the portfolio to gold as a hedge against market volatility and inflation. Financial advisors often suggest allocating around 5% to 20% of the total portfolio value to gold investments, including SGBs.

Diversification Strategies with SGBs

There are various diversification strategies to consider when incorporating SGBs into an investment portfolio:

Equity-Bond-Gold Mix: Allocate a portion of your portfolio to equities, bonds, and SGBs. This mix helps balance risk and return, with equities providing growth potential, bonds offering stability, and gold acting as a hedge.

Systematic Investment: Invest in SGBs systematically over time, taking advantage of rupee cost averaging. This approach reduces the impact of short-term price fluctuations.

Geographical Diversification: Consider investing in SGBs along with international gold funds or other gold-related investments to diversify exposure across different markets.

Risks and Mitigation

While SGBs offer several benefits, it is important to be aware of the associated risks and take appropriate measures to mitigate them:

Gold Price Volatility: The value of SGBs is influenced by the fluctuation in gold prices. Understand the historical price trends and consult market experts to make informed investment decisions.

Interest Rate Risk: SGBs carry an annual interest rate, which is fixed on the buy price of SGBs. Which means even if the value of gold increases your interest income remains same throught the tenure of bond.

Liquidity Risk: SGBs have a tenure of 8 years, and premature redemption is allowed after the fifth year. Consider your liquidity requirements before investing.

Tax Implications of SGB Investments

SGBs have certain tax implications that investors should be aware of:

Interest Income: The interest earned on SGBs is taxable as per the investor’s income tax slab rate.

Capital Gains: If SGBs are sold before maturity, capital gains will be taxable. However, long-term capital gains are tax-exempt if held until maturity.

Monitoring and Rebalancing the Portfolio

Regularly monitor the performance of your investment portfolio, including SGBs. Rebalance the portfolio periodically to maintain the desired asset allocation. Seek professional advice if needed to make informed decisions.

Pricing of SGBs

Price of SGB is fixed in Indian Rupees on the basis of simple average of closing price of gold of 999 purity, published by the India Bullion and Jewellers Association Limited (IBJA) for the last three working days of the week preceding the subscription period. Same formula is used for pricing SGBs for premature withdrawal after 5 years. And if any investor buys SGBs through online mode they get discount of ₹50 per gram.

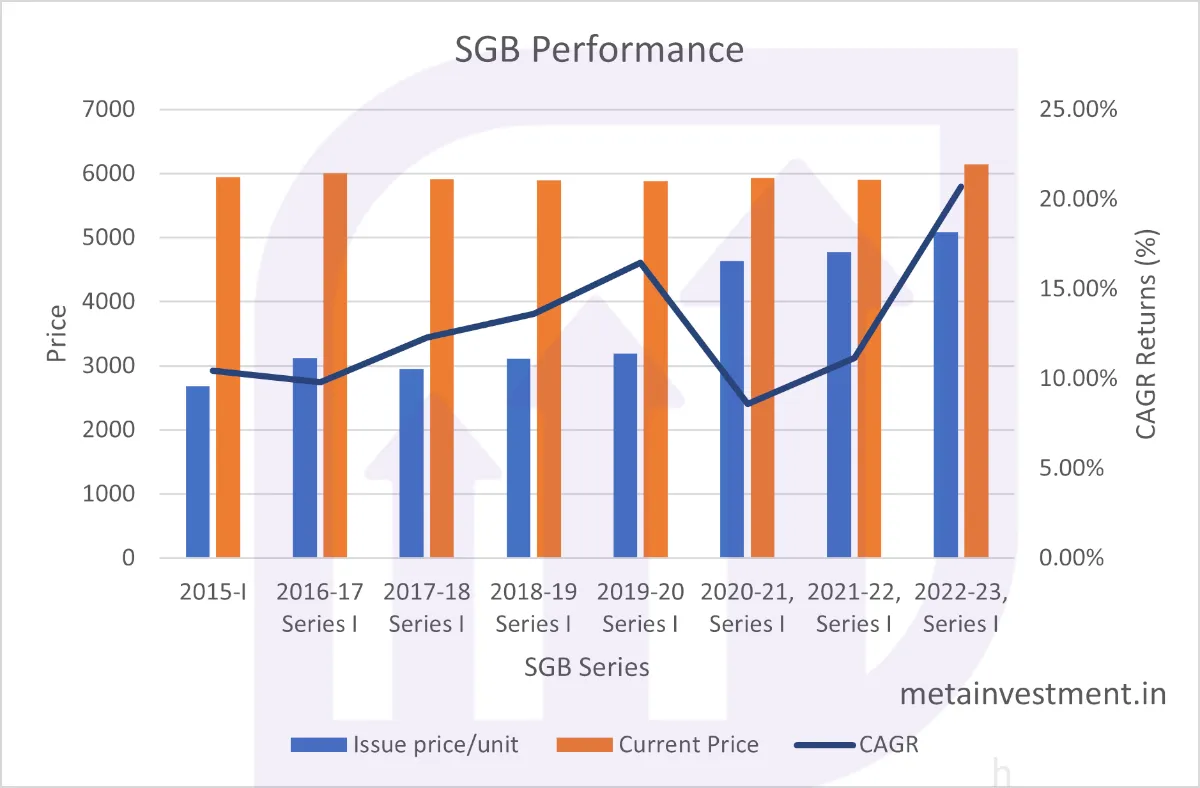

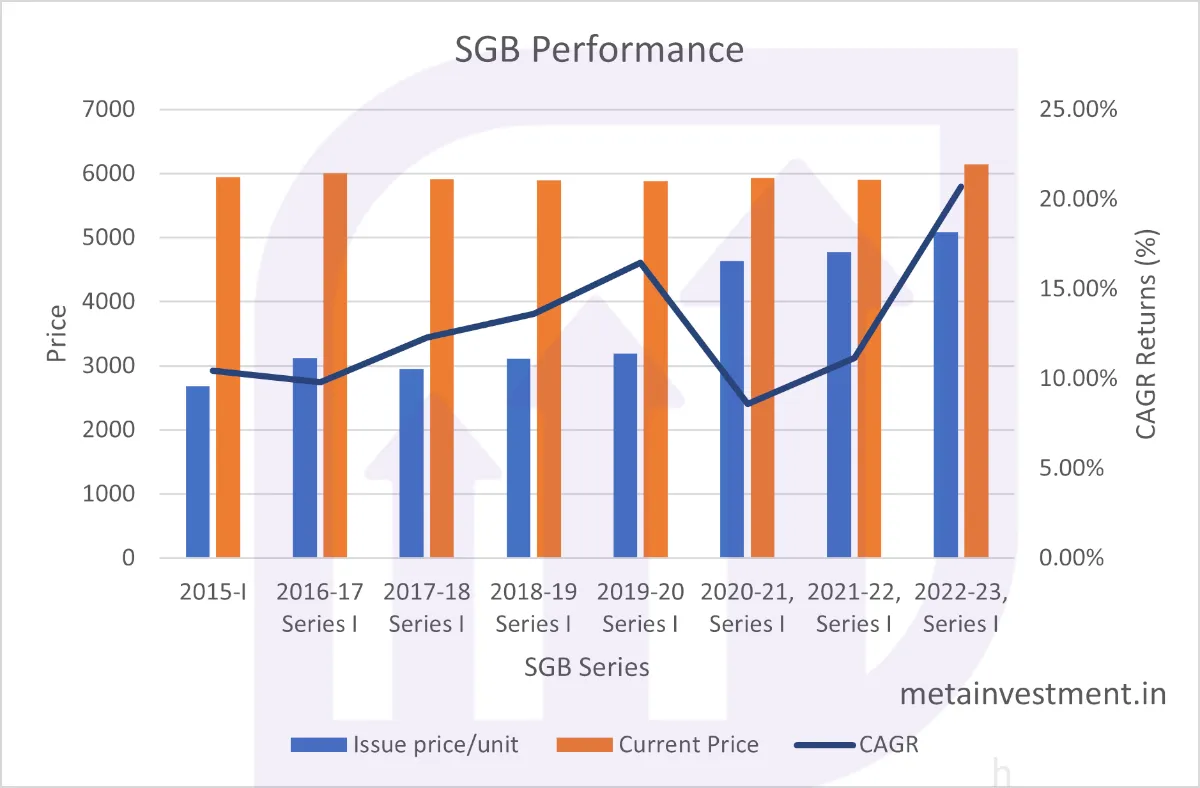

First tranche of SGBs came for subscription in November 2015. It was priced at ₹2684/- at that time. At present these SGBs are trading at a value of ₹5933/- as NSE data. This translates into CAGR growth of 10.42% without considering interest payout. And if we add interst also overall returns come to 11.74%. This first tranche will be maturing this year in November. See the graph of performance of first series of each financial year.

Sovereign Gold Bond (SGB) Tranche for 2023-24

RBI has planned two series of SGBs issues for the year 2023-24 as per below schedule. You may consider subscring to SGBs as per your asset allocation.

| S. No. | Tranche | Date of Subscription | Date of Issuance |

| 1 | 2023-24 Series I | June 19 – June 23, 2023 | June 27, 2023 |

| 2 | 2023-24 Series II | September 11 – September 15, 2023 | September 20, 2023 |

Conclusion

Asset allocation with SGBs can be a valuable addition to an investment portfolio. These bonds offer a secure and regulated way to invest in gold, providing safety, regular income, and potential capital appreciation. By considering factors such as financial goals, risk profile, and diversification strategies, investors can effectively allocate their assets to SGBs and benefit from their unique features.

FAQs

1. How can subscribe to SGBs?

You can subscribe to new series for SGB through various online mode such as your broker or your bank. Meta Investment offer you integrated option of subscribing to SGBs directly. Connect today with us for subscribing to SGB.

2. Are SGBs traded on stock exchanges?

Yes, SGBs can be bought and sold on stock exchanges through designated market makers.

3. Are SGBs a good investment option for long-term goals?

SGBs can be suitable for long-term goals as they offer a fixed tenure of 8 years and potential capital appreciation.

4. Do I need a demat account to invest in SGBs?

To invest in sovereign gold bonds, you do not need a demat account. Customers who do not have a demat account will receive both physical and electronic certificates.

5. How is the interest on SGBs paid?

The interest on SGBs is paid semi-annually directly to the investor’s bank account.

6. Can I sell SGBs before the maturity period?

Yes, SGBs can be sold on stock exchanges after the fifth year of the bond’s tenure.