In the diverse landscape of investment options available in India, gold and fixed deposits stand out as two popular choices for individuals seeking stability and growth. Both offer unique advantages and cater to different investment goals. This article delves into the world of gold and fixed deposits in India, comparing their key features, potential returns, and associated risks. By exploring the pros and cons of these investment avenues, you can make an informed decision that aligns with your financial aspirations.

Gold vs Fixed Deposit in India: A Comprehensive Comparison

Investors often find themselves at a crossroads when deciding between gold and fixed deposits. Both options have their merits, and understanding their nuances can help you choose the one that suits your needs best. Let’s delve into the comparison.

Gold Investments: A Shimmering Option

When it comes to investing in gold, individuals often consider it a reliable store of value that has stood the test of time. Here’s what you need to know about gold investments:

Historical Significance of Gold:

From ancient civilizations to the modern world, gold has been revered as a symbol of wealth and a hedge against economic uncertainties. Gold’s rich history and enduring value make it an attractive investment avenue for many.

Potential Returns:

Gold prices have witnessed significant appreciation over the years, providing investors with the possibility of capital appreciation. While gold’s value may fluctuate in the short term, long-term investments tend to benefit from its growth potential. Looking at the historical data, gold has given returns of 9% CAGR over last 30 years period.

Portfolio Diversification:

Gold investments offer diversification benefits by reducing the overall risk of a portfolio. By including gold in your investment portfolio, you can offset potential losses in other asset classes during economic downturns.

Liquidity:

Gold is a highly liquid asset, allowing investors to buy or sell it easily in various forms such as jewelry, bars, or coins. This liquidity feature makes gold an attractive option for investors seeking quick access to funds.

Taxation:

The taxation aspect of gold investments is essential to consider. In India, the capital gains tax is applicable when selling gold. Short-term capital gains are taxed at the individual’s income tax rate, while long-term gains are subject to a flat tax rate.

Fixed Deposits: Stability and Assured Returns

Fixed deposits, on the other hand, have long been favored by risk-averse investors for their stability and assured returns. Here’s a closer look at fixed deposits in India:

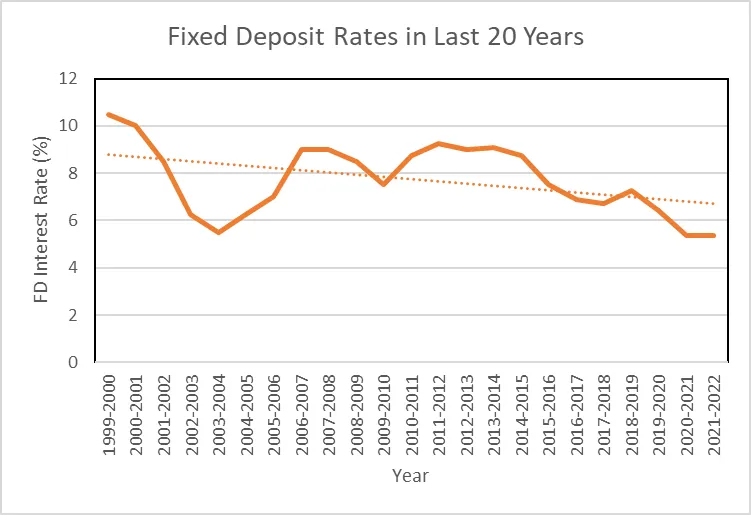

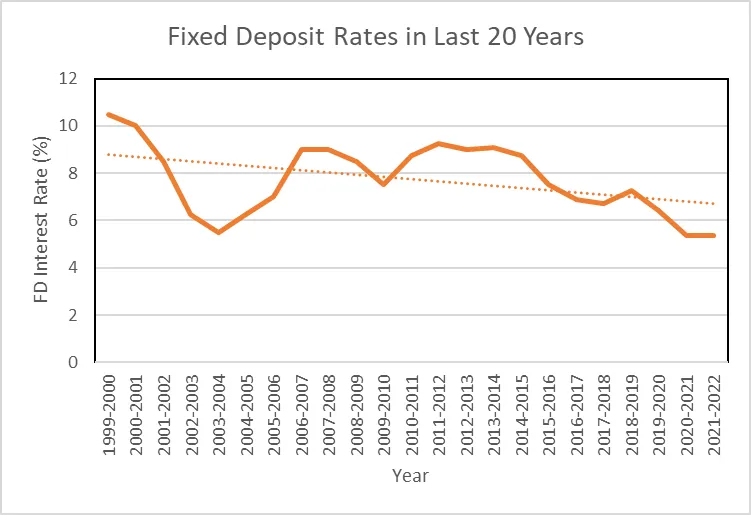

Steady Returns:

Fixed deposits offer a fixed interest rate that is predetermined at the time of investment. This certainty makes them an attractive option for individuals seeking stable returns over a specified period.

Low Risk:

Fixed deposits are considered low-risk investments, as they are not influenced by market volatility. Investors can rely on the guaranteed returns and the safety of their principal amount.

Flexible Tenures:

Fixed deposits provide investors with a range of tenure options, allowing them to align their investments with their financial goals. Whether short-term or long-term, fixed deposits offer flexibility in choosing the investment duration.

Loan Against Deposit:

In times of financial emergencies, individuals can avail of loans against their fixed deposits. This feature provides liquidity and helps individuals avoid premature withdrawals.

Taxation:

Fixed deposits are subject to taxation in India. The interest earned from fixed deposits is added to the individual’s income and taxed as per their applicable income tax slab.

Gold vs Fixed Deposit in India: Frequently Asked Questions

To provide you with further clarity, here are some common questions related to gold and fixed deposits in India:

1. Which investment option offers higher returns, gold or fixed deposits?

When comparing potential returns, gold has the advantage of capital appreciation over the long term. However, fixed deposits offer guaranteed returns at a predetermined interest rate.

2. Are gold investments affected by market fluctuations?

Yes, gold prices can be influenced by market fluctuations, which may lead to short-term volatility. However, over the long term, gold has historically shown growth potential.

3. Can I prematurely withdraw my fixed deposit?

While fixed deposits offer stability, premature withdrawal may result in penalties and a lower interest rate. It is advisable to carefully consider the tenure before investing in a fixed deposit.

4. Which option is more suitable for short-term goals?

For short-term financial goals, fixed deposits are a preferable choice due to their fixed interest rates and low risk. Gold investments may be more suitable for long-term goals.

5. What is the taxation on gold and fixed deposits?

Gold investments are subject to capital gains tax in India, while fixed deposit interest is added to an individual’s income and taxed accordingly. The tax rates differ based on the holding period and income tax slab.

6. Can I take a loan against my gold investment or fixed deposit?

Yes, both gold investments and fixed deposits offer the option of availing loans against them. This allows individuals to meet their financial needs without liquidating their investments.

When it comes to choosing between gold and fixed deposits in India, it’s essential to consider your financial goals, risk tolerance, and investment horizon. Gold offers the potential for capital appreciation and acts as a diversification tool, while fixed deposits provide stability and guaranteed returns.

Ultimately, the choice between gold and fixed deposits depends on your investment objectives and personal preferences. It may be beneficial to consult a financial advisor who can assess your individual circumstances and guide you towards the most suitable investment option.

Remember to weigh the advantages, risks, and taxation aspects associated with each option. By making an informed decision, you can optimize your investments and secure a better financial future.