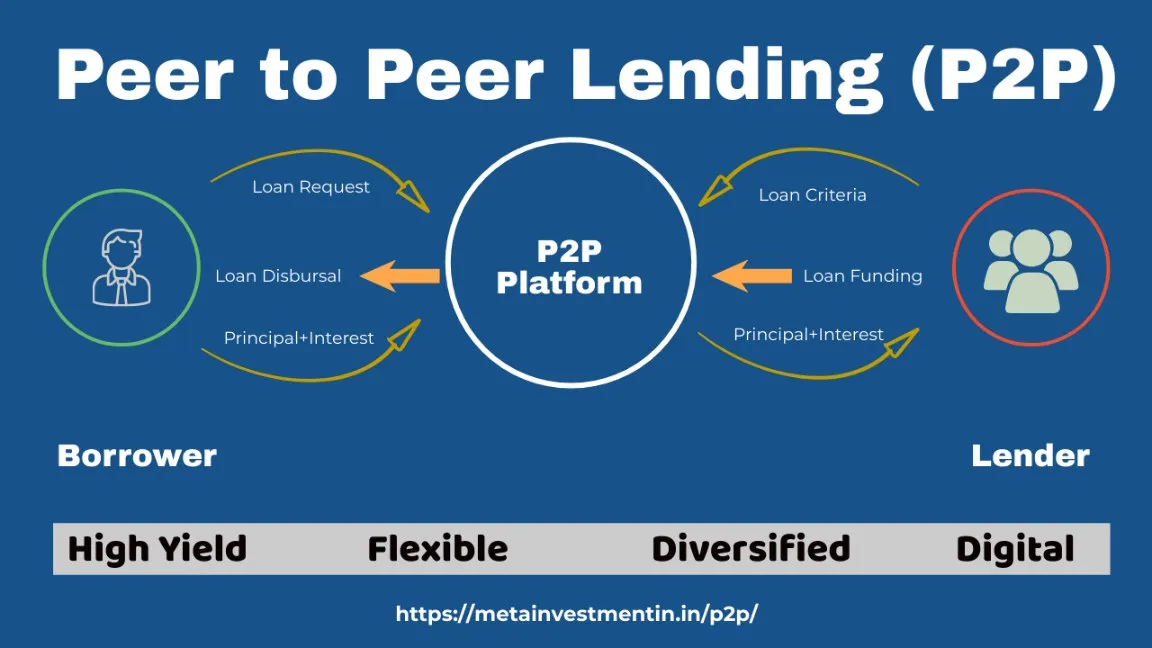

पीअर टू पीअर (P2P) कर्ज ही भारतातील तुलनेने नवीन संकल्पना आहे, जिने अलिकडच्या वर्षांत लोकप्रियता मिळवली आहे. हे एक ऑनलाइन कर्ज देणारे प्लॅटफॉर्म आहे जे बँकांसारख्या पारंपारिक वित्तीय संस्थांच्या कोणत्याही सहभागाशिवाय कर्जदार आणि कर्ज देणारे थेट जोडते. हे विविध कर्ज देणारे प्लॅटफॉर्म NBFC-P2P मार्गदर्शक तत्त्वांनुसार RBI (भारतीय रिझर्व्ह बँक) द्वारे नियंत्रित केले जातात. सावकार कर्जदारांना थेट पैसे देत असल्याने त्याचा परिणाम कर्जदारांसाठी कमी खर्चिक कर्जात होतो परंतु त्याच वेळी, गुंतवणूकदारांसाठी जोखीम-समायोजित परतावा अधिक असतो. P2P कर्ज देणारे प्लॅटफॉर्म कर्जदारांना त्यांची क्रेडिट योग्यता, जोखीम प्रोफाइल आणि इतर संबंधित घटकांवर आधारित गुंतवणूकदारांशी जुळण्यासाठी अत्याधुनिक अल्गोरिदम आणि डेटा विश्लेषणे वापरतात.

पीअर टू पीअर (P2P) कर्ज ही भारतातील तुलनेने नवीन संकल्पना आहे, जिने अलिकडच्या वर्षांत लोकप्रियता मिळवली आहे. हे एक ऑनलाइन कर्ज देणारे प्लॅटफॉर्म आहे जे बँकांसारख्या पारंपारिक वित्तीय संस्थांच्या कोणत्याही सहभागाशिवाय कर्जदार आणि कर्ज देणारे थेट जोडते. हे विविध कर्ज देणारे प्लॅटफॉर्म NBFC-P2P मार्गदर्शक तत्त्वांनुसार RBI (भारतीय रिझर्व्ह बँक) द्वारे नियंत्रित केले जातात. सावकार कर्जदारांना थेट पैसे देत असल्याने त्याचा परिणाम कर्जदारांसाठी कमी खर्चिक कर्जात होतो परंतु त्याच वेळी, गुंतवणूकदारांसाठी जोखीम-समायोजित परतावा अधिक असतो. P2P कर्ज देणारे प्लॅटफॉर्म कर्जदारांना त्यांची क्रेडिट योग्यता, जोखीम प्रोफाइल आणि इतर संबंधित घटकांवर आधारित गुंतवणूकदारांशी जुळण्यासाठी अत्याधुनिक अल्गोरिदम आणि डेटा विश्लेषणे वापरतात.

Benefits of P2P Lending in India

Access to Credit P2P lending platforms provide access to credit to individuals who are unable to obtain loans from traditional financial institutions like banks. This is especially true for borrowers with poor credit scores or no credit history. P2P lending platforms use alternative credit scoring models to evaluate a borrower’s creditworthiness, which allows them to offer loans to a broader range of borrowers.

Lower Interest Rates P2P lending platforms offer loans at lower interest rates than traditional financial institutions like banks. This is because they have lower overhead costs and do not have to maintain physical branches or employ a large workforce. Lower interest rates make borrowing more affordable and can help borrowers save money on interest payments.

Diversification of Investments P2P lending platforms provide an opportunity for investors to diversify their investments by investing in a range of loans with varying risk profiles. This diversification helps investors to spread their risk and reduce the impact of defaults on their overall portfolio.

Challenges of P2P Lending in India

Lack of Regulation P2P lending is a new concept in India, and there is no specific regulation governing its operations. While the Reserve Bank of India (RBI) has issued guidelines for P2P lending platforms, there is no specific regulatory framework for the industry. This lack of regulation creates a risk for both borrowers and lenders.

Default Risk P2P lending involves lending money to individuals who may not have a strong credit history or may have a high risk of default. This default risk can lead to losses for lenders who invest in such loans. P2P lending platforms try to mitigate this risk by using sophisticated algorithms and data analytics to evaluate a borrower’s creditworthiness.

P2P Lending Eligibility

As per RBI’s directives, an entity with valid KYC documents (PAN Card, Address Proof, Indian Bank Account, Email Id & Mobile No.) can lend via a Peer-to-Peer Platform. Eligible Entities include:

- Individual (18 years old or above)

- HUF

- Corporate (Incorporated under Indian Companies Act or RBI Listed Finance Companies)

- Partnership Firm

- Limited Liability Partnership (LLP)

- Body of Individuals

- Society

- Artificial Body

How much I can invest/borrow on P2P platforms?

Any individual entity can lend up INR. 50 lakhs across all P2P lending platforms, where as it can borrow loans up to 10 lakhs INR.

How to get started?

P2P lending is a new and innovative concept in India that offers an alternative source of credit to borrowers who are unable to obtain loans from traditional financial institutions. The industry is still evolving, and there are challenges to its growth, including lack of regulation and default risk. However, P2P lending has the potential to revolutionize the lending industry in India by providing affordable credit to a wider range of borrowers and offering investors an opportunity to diversify their investments. As the industry matures and gains wider acceptance, it has the potential to become a significant player in the Indian financial ecosystem.

To understand more about P2P lending/borrowing you can contact us over phone/email/WhatsApp.

LIQUILOANS is one major CRISIL assessed P2P platform. To register with LiquiLoan as invester click here and follow simple instructions.